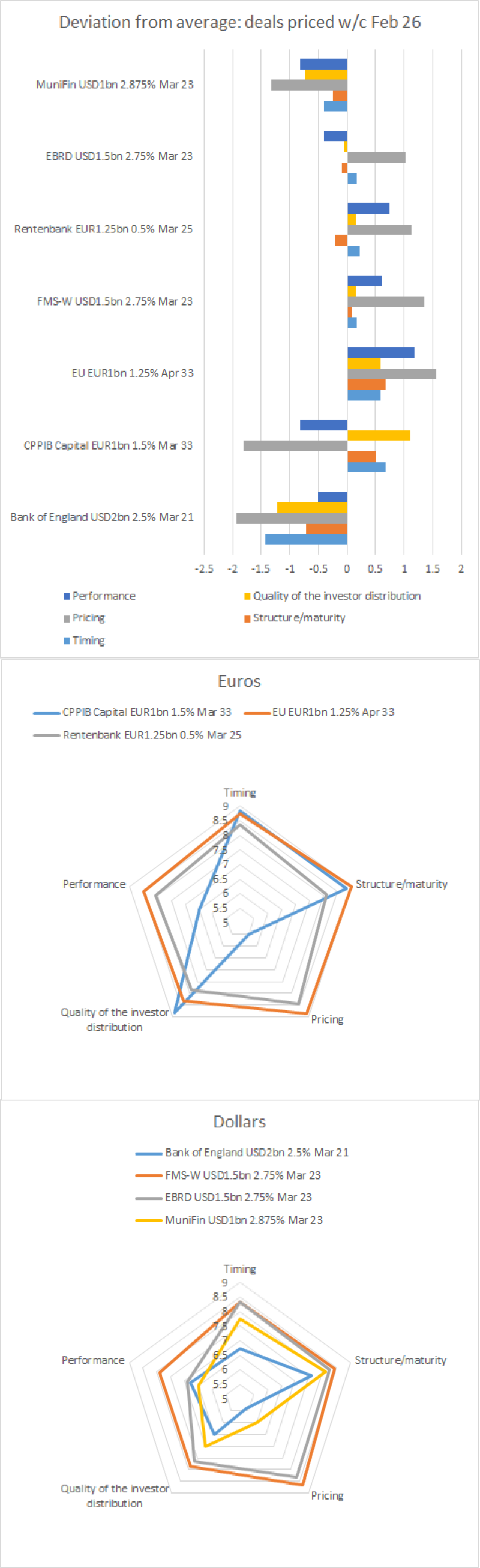

The EU’s €1bn 1.25% April 2033 scored 8.69 across the five categories available for voting on BondMarker (timing, structure/maturity, pricing, quality of the investor distribution and performance).

The deal, led by Citi, Crédit Agricole, Deutsche Bank and LBBW, attracted orders of over €6.7bn and was priced flat to fair value, according to one of the leads.

“A few weeks ago the market was worrying about QE ending and what that will do to secondary performance and so on,” said a banker away from the deal at the time. “This deal handled that background well.”

The deal’s scores were higher than those for a 15 year tap by the European Investment Bank priced the week before. EIB’s deal was the highest overall scorer on BondMarker last week, having an average score of 8.59.

The next highest scorer this week was a dollar print from German wind-up agency FMS Wertmanagement. The $1.5bn five year, led by Bank of America Merrill Lynch, Barclays, Goldman Sachs and HSBC, scored 8.24 across the five categories, with particularly high marks in the pricing category.

A euro benchmark from Rentenbank rounded off the top three. Voters scored the €1.25bn March 2025 deal an average of 8.175. Like FMS-W’s deal, Rentenbank’s print gained its highest marks in the pricing category.

The only other euro benchmark of the week was from CPPIB Capital. The €1bn March 2033 achieved a decent 7.7.

Dollar deals’ fortunes were more mixed. Aside from FMS-W's deal, European Bank for Reconstruction and Development had a strong performance — 7.9 — with a $1.5bn five year that scored 8.3 in the timing and pricing categories. Municipality Finance was awarded 7.07 for a $1bn five year. Bank of England brought up the rear with a $2bn three year that scored 6.61. Its highest marks were in the structure/maturity category and lowest in pricing.