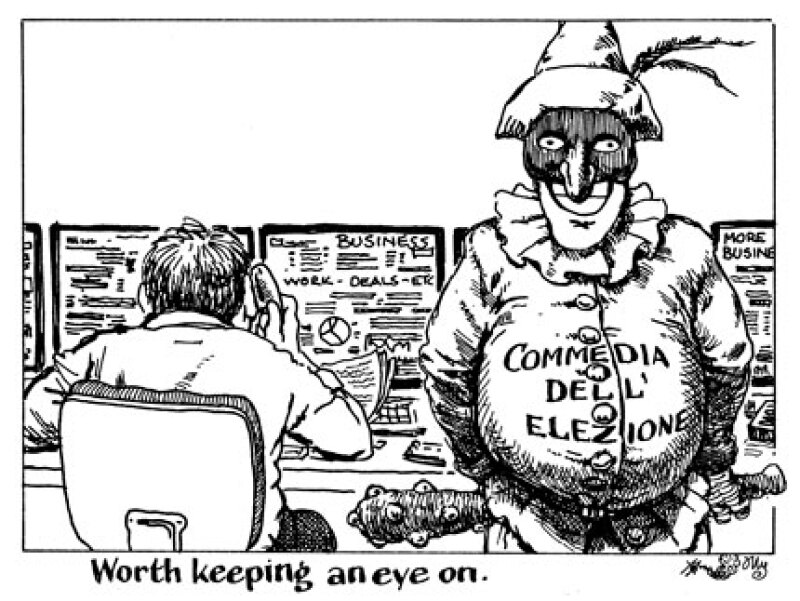

The most likely result of Sunday's election will be confusion, with a hung parliament and coalition government likely to follow.

Many have Italy’s favourite clown prince, Silvio Berlusconi, holding the keys to power after the vote, although he is banned from taking political office himself.

But with a large percentage of Italians still undecided, as of the last political polls, you cannot rule out the Five Star Movement outperforming expectations. They continue to be widely tipped to be the largest party in the Italian legislature, despite most writing off their chances of being part of a coalition government.

Even if the pundits are proved right and the Berlusconi coalition is successful in forming a government, it will likely be a coalition backed by the anti-immigration Northern League and the Brothers of Italy, a party widely considered the heir to Italy’s fascist movement. Neither is particularly enamoured with the EU.

The bloc’s plans for Italy, as well as its core ideals, could easily be challenged by a populist/nationalist government as has happened in Poland.

The continued success of anti-establishment parties reveals a deep dissatisfaction in Italy with the status quo. There is a nationalist fervour in Italy that presents far more risk in the medium term than many in the markets are making allowances for.