You have until November 23 to deliver your verdict on a $2bn 2.5% print from World Bank, which was priced on Tuesday.

Head to www.about.globalcapital.com/bondmarker to get voting. It’s worth your while: voters see results first.

US Treasury yields have spiked since September, making deals in the maturity — famously tricky to execute — an alluring prospect for public sector issuers, as they can offer investors a bit of yield without compromising their levels versus US Treasuries.

Only five benchmarks scored on BondMarker so far this year have been dollar 10 years. But the choice of maturity is clearly a hit with voters.

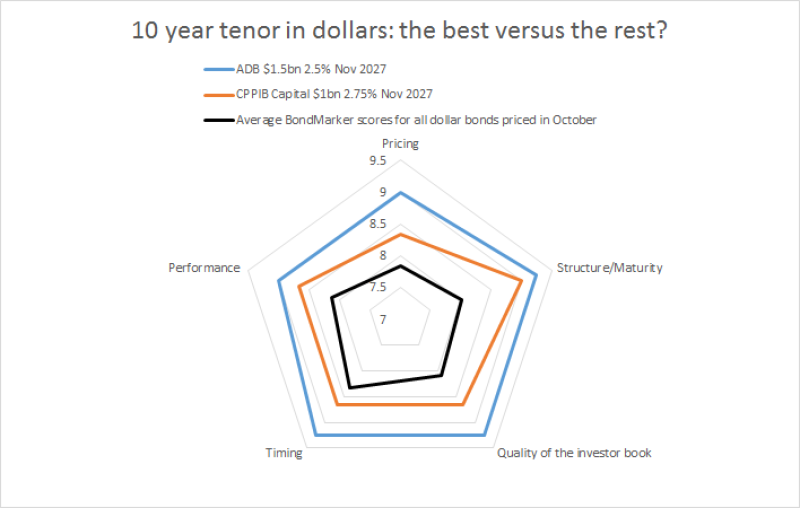

Nearly all the 10 year dollar deals scored have achieved above average scores, looking across the five available categories for scoring: pricing, structure/maturity, quality of the investor book, timing and performance. The five have all scored above average in the structure/maturity category.

The two most recent prints — a $1.5bn 2.5% November 2027 from Asia Development Bank and a $1bn 2.75% November 2027 from CPPIB Capital, both priced on October 24 — have achieved markedly higher scores than the average of all dollar deals printed in the same month.

Want to learn more about BondMarker? Go to www.about.globalcapital.com/bondmarker. If you have any queries on BondMarker or would like us to add you to our distribution list, please email Tessa Wilkie, data editor, on tessa.wilkie@globalcapital.com. Remember, voters see results first and will have access to exclusive analysis.