According to the front pages of the UK’s famously trustworthy mainstream newspapers, the year is 1976 and a Labour prime minister has gone cap in hand to the IMF for a bailout.

Long end Gilt yields are at their highest since 1998, when Geri Halliwell left the Spice Girls and the Bank of England gained its independence.

Sterling exchange rates, meanwhile, have taken a beating as pressure ramps up at the long end of the Gilt curve. Earlier this week, sterling slumped to a multi-week low against the euro and dollar.

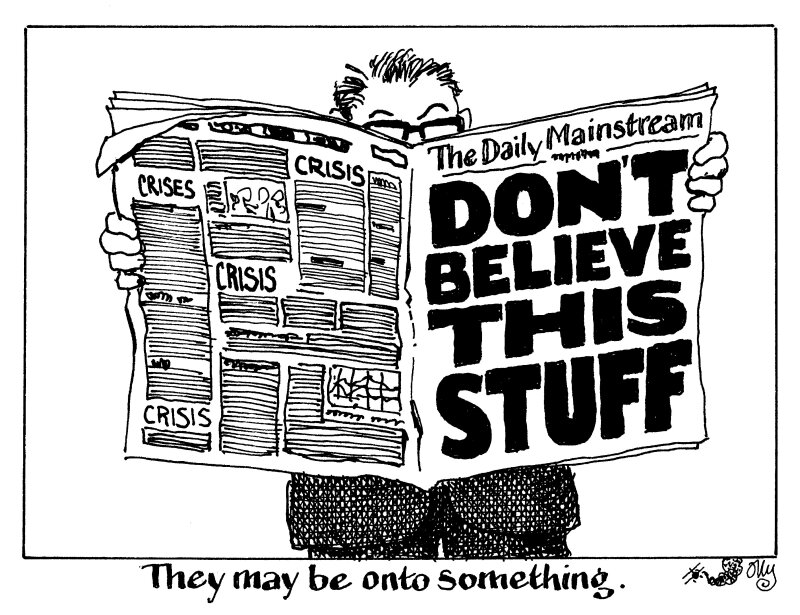

As a result, from the outside, you’d be forgiven for thinking UK debt markets are heading for another Liz Truss moment. In fact, several of those newspapers are desperately trying to persuade you of this.

But go inside the bond market to where the action is, and you'll see business as usual — if not, sometimes, better than usual.

In the teeth of the so-called storm on Tuesday, the UK Debt Management Office pulled off its largest ever Gilt issue. The £14bn 10 year syndication garnered an exceptionally strong £141bn final orderbook, full of high quality international investors.

Meanwhile, the sterling credit market is chugging along. Corporate, bank and covered issuers — UK-based and foreign — have completed attractively priced deals in recent weeks, landing close to or even through secondary curves.

Sterling issuance so far this year lags behind 2024, with investors chasing a thin layer of supply. And only a modest pipeline of fresh paper is expected in the coming weeks.

Unfortunately, Rachel Reeves, the chancellor of the exchequer, has opted for a late November budget. That gives the papers more time to churn out hyperbolic headlines.

This is likely to cause more Gilt market volatility — but as this week's executions have shown, it should be taken with a pinch of salt.

Reeves faces a daunting 12 weeks until she comes to the despatch box.

If primary markets persist in shrugging off the widespread volatility, then for issuers the next 12 weeks will be a lot happier.