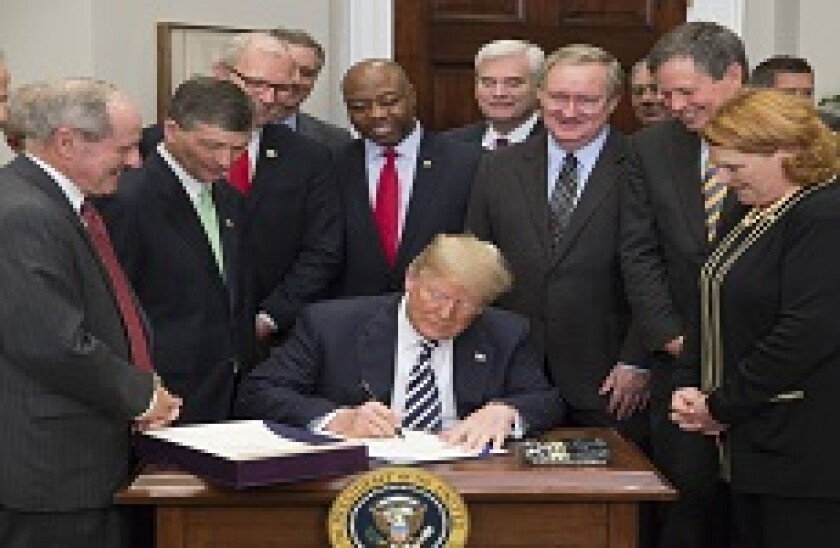

US president Donald Trump was clearly in high spirits when he was invited to sign the Economic Growth, Regulatory Relief and Consumer Protection Act into law earlier this year.

“This is all about the Dodd-Frank disaster,” he told a press conference in May, surrounded by members of Congress from the Republican and the Democratic parties. “They fixed it,” he continued. “Or at least they have gone a long way towards fixing it.”

The law in question — known as the Crapo Act after senator Mike Crapo, chair of the Senate Banking Committee at the time — is seen as the biggest rollback of US financial regulation since the crisis. It freed domestic banks with up to $250bn in assets from having to comply with some of the requirements the Dodd-Frank Act introduced in 2010, tailoring the leverage ratio and stress testing demands for institutions according to various different size thresholds.

With the introduction of the Crapo Bill into law, some commentators fear that the US is moving out of step with an international consensus on tougher banking rules.

The new legislation offers regulatory relief for smaller financial institutions and is a signal that the country’s rule makers were beginning to reverse on financial regulation more generally. Indeed, at the same press conference, Trump indicated that it might not be enough for the US to release small banks from “Dodd-Frank’s brutal maze of costly regulations”.

“Maybe we’re going to have to start looking at that also for the larger institutions, because they also are put at a disadvantage in terms of loaning money to people wanting to open up businesses,” he said.

We’re going through changes

In the mid-term elections this November, the Republican Party failed to maintain a majority in both chambers after being beaten by the Democratic Party in the race for the House of Representatives.

The Republicans had been driving the changes to Dodd-Frank, but they will now lose control of influential committees in the lower chamber, such as the House Financial Services Committee. Sir Paul Tucker, chair of the Systemic Risk Council which encourages regulatory reform in the US capital markets, says that this committee has been “in the vanguard of deregulation proposals over the past few years”.

Its former chair, Republican Jeb Hensarling, was instrumental in laying the foundations for the Crapo Act with his effort to roll back post-crisis financial regulation, known as the Financial CHOICE Act.

“There is unlikely to be much in the way of legislation on financial services in the US in the next few years, given that the House and Senate are in the hands of rival political parties,” says Tucker, also a former deputy governor of the Bank of England. But that does not mean that a further relaxation of the rules is no longer on the cards in the US. Instead, the baton will now pass to the regulatory agencies, which play an important role in proposing and introducing new requirements for the banking sector.

Tucker explains that, in recent decades, legislation from Congress has increasingly acted like an “essay question” for regulators to answer. “They can often exercise quite a lot of discretion in their rulemaking,” he says.

Early signs suggest that the agencies will use this discretion to loosen rather than tighten their grip on the US banking sector. For example, five federal regulators put out a joint statement in mid-September in which they sought to clarify the role of guidance in the supervision of financial firms. They stressed that not adhering to guidance will not lead to “enforcement action” as it does not have the “effect of law”.

“It was an interesting statement that the industry took as a sign that supervision and regulation would be thoughtfully applied to a given bank’s profile,” says Sara Lenet, counsel at Hogan Lovells in Washington DC.

This is exactly the tone that many of the agencies have been trying to strike when formulating new rules for financial services firms in recent months. Indeed, the Federal Reserve has proposed easing liquidity requirements for all but the very largest US banks, as part of its efforts to implement the terms of the Crapo Act. Those with assets of less than $100bn stand to gain the most from the rollback, while those in the $100bn-$250bn range could escape a rule requiring them to have enough liquid assets to operate for 30 days.

“Regulators have indicated that they are looking to reduce regulatory burdens on banks and streamline requirements,” Lenet says. “We have seen a lot of that type of activity following leadership changes in the regulatory agencies.”

Indeed, the Trump administration has redefined some of the major US regulators, choosing more Wall Street-friendly figures to head them. Nine out of 10 of the voting members of the Financial Stability Oversight Council (FSOC) were chosen by Trump, leaving Mel Watt, director of the Federal Housing Finance Agency, the only Democrat.

Towards a new world order

Europe, for example, still has a packed calendar for reforms. The region is working towards strengthening the Banking Union — a common set of rules ensuring closer supervisory ties for banks across participating member states — and is preparing to implement the Basel IV reforms and strengthen its rules on dealing with non-performing loans.

For Nicolas Véron, a senior fellow at Bruegel, the two jurisdictions’ different emphases makes sense.

“There are plenty of bank lobbyists that would argue that Europe needs to deregulate in order to level the playing field with the US,” he says. “But that is a false premise, a false narrative. The US was starting with a more restrictive framework than Europe. They are not at a competitive advantage.”

Véron notes that the US has done more to implement the Basel Committee’s international standards than many other jurisdictions, including Europe. But there are some creeping signals that US regulators may be losing interest in leading the way on tougher global financial regulation.

Following the crisis, the US has been at the forefront of trying to regulate risks that could arise from the non-bank financial sector. Via the Dodd-Frank Act, the government bestowed powers on the FSOC to designate non-banks as systemically important financial institutions (SIFIs), implying tougher federal oversight and supervision. But, in October, the FSOC voted unanimously in favour of declassifying Prudential Financial as a SIFI, wiping the only remaining name from its once four-strong list.

Steven Mnuchin, secretary of the Treasury, had previously indicated that government would look at “several ways to improve FSOC’s processes for designating non-banks and financial market utilities”. But little has come out of this review.

This has left international bodies such as the Financial Stability Board (FSB) to pick up the mantle in this area, while Europe pushes on with work to develop a recovery and resolution framework for the insurance industry.

“The ability for the US to head off systemic threats outside of banking, or require resilient intermediaries outside banking, is limited,” says Tucker.

As the US has begun to strip back supervision and legislation, there has nonetheless been renewed debate around what constitutes appropriate regulation of the financial sector.

Nobody would call the Crapo Act a repeal of Dodd-Frank. Véron says that most of the changes that have been implemented by the new legislation have been “quite modest and quite natural”.

Indeed, it was focused on “community banks” — deposit-taking institutions that generally have under $10bn in assets and are unlikely to require as close a level of supervision as more systemic financial institutions.

But some observers fear cracks are appearing around the idea that large banks reducing their level of risk to the system should be paramount — a topic that has often found an uneasy consensus in international finance.

Much has been made of the decision to raise the threshold at which stricter federal oversight would apply to a US bank from $50bn in assets to $250bn, for example, though the Fed would still have prudential control over banks with at least $100bn.

Tucker is concerned that US regulators are not certain that some of these banks could be put through a bankruptcy procedure without causing ripples in the economy.

“Peeling back regulation on the resilience of the largest banks is not sensible,” he says. “The medium-sized banks, too, are big — big enough that if they became distressed it would cause quite a clatter.”

There is also a feeling that US rule makers may be stepping away at the wrong time. Risks are rising in the global financial system as market conditions tighten and major world economies enter into a late stage in the economic cycle.

“Dodd-Frank was finalised very quickly, in 2010, and by then the post-crisis thinking about what is needed to preserve a stable financial system was still at an early stage,” says Tucker. “That has left the US regulatory system — which is the most important one in the world — incomplete in terms of providing the American people with adequate defences against systemic risk.”