Several Asian nations have caught the attention of investors as the performance of frontier markets continues to overshadow their emerging market counterparts.

Nigeria and Kazakhstan offer the best opportunities, according to a new benchmark report by Renaissance Capital, which combines national macro conclusions with screens around valuation, growth, liquidity and analyst opinion.

|

While Nigeria has attracted significant debt and equity fund flows from international investors, and is considered Africa’s market darling, the appearance of Kazakhstan is more striking: the country’s stock market performance has been disappointing, standing at roughly the same level today as in early 2012.

“Kazakhstan is surprising its demographics,” Charles Robertson at Renaissance told Emerging Markets. “It looks better than most of the former Soviet Union and has a lot of young people coming through. It’s got good public finances and external accounts and is also quite cheap, because it falls between two stools: Asian investors tend not to include Central Asia in their remit, and for emerging Europe investors it’s a trek to get there.”

Two other Asian frontier markets score well in the study’s methodology. Both Pakistan and Bangladesh are in a strong demographic position, with large populations, within which high proportions are entering the working age group. Pakistan also has room for private sector debt growth and has a high trailing dividend yield and return on equity, while Bangladesh has enjoyed one of the highest levels of GDP growth in the frontier world, has impressive forecast EPS growth to match and is in a strong current account position.

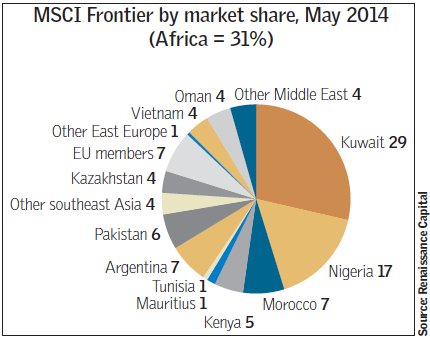

The report notes that the 35 countries it considers to be “frontier” have a combined population of one billion, nearly $2tr of equity market capitalisation and daily turnover of $3.8bn.

TRANSITION PAIN

Sri Lanka and Vietnam did not fare as well, however. Robertson said: “Regime change is inevitable, from autocracy to democracy, further down the line in Vietnam” among other places, and that transition tends to have at least a short term negative impact on market performance.

“Also Vietnam has used the Chinese model of taking large amounts of deposits, putting them through the state banking system and fuelling investment through high levels of debt. Vietnam’s level of private debt needs to be watched carefully.”

Vietnam is the most sensitive frontier market to exports, Renaissance concluded, as well as having relatively high public sector debt.

Sri Lanka scores poorly in terms of demographics, with a relatively small part of the population due to enter the working age group.

Renaissance is not alone in seeing the opportunity in frontier markets. Tomás Guerrero, a researcher at Spain’s Centre for Global Economy and Geopolitics, calls frontier markets “a set of heterogeneous countries that, up to a decade ago, were characterised by their instability, limited access and low liquidity” but now represent “a real alternative to developing economies” for investors.