China-blow-up-scenario news, now. Amid the current market euphoria, a stark warning from the IMF: a full-scale financial crisis emanating from the eurozone could trigger a hard landing for the Chinese economy.

That's an eminently reasonable conclusion to draw but, more usefully, the Fund has proffered some numbers to digest the severity of this scenario.

In its latest China Economic Outlook, published today, the Fund warns that - the uncomfortably fat - tail risk of financial volatility emanating from Europe could slash around 4 percentage points off China’s growth numbers, dragging GDP growth down to around 4%.

That’s a significantly higher than the tail-risk scenario for the global economy highlighted by the Fund, which is for global growth to fall by 1.75 percentage points.

Here’s how the Fund reckons that the feedback/spillover would affect China:

| The [Fund] envisages a global downside scenario under which intensification in adverse feedback loops between sovereign and bank funding pressures in the euro area results in sizeable contractions in credit and output. ... China would be highly exposed through trade linkages. Europe and the United States together account for nearly half of China’s total exports. Lower global demand would, therefore, feed back negatively to corporate and financial sector balance sheets, hampering the performance of firms in the tradable sector (where excess capacity is already prevalent), increasing NPLs, and potentially prompting banks to deleverage. This would further reduce investment, employment and growth and could trigger a decline in China’s property market. |

So, in sum: trade slowdown -> corporate slowdown -> rising NPLs -> bank deleveraging -> a decline in employment, growth and asset prices ->property crash.

Cheery stuff, and broadly in line with the World Bank’s recent warning that a full-blown eurozone crisis could trim 4-5 percentage points off emerging market growth rates. However, there is a big caveat to the Fund’s pessimistic scenario (emphasis is as per the original report):

| In the absence of a domestic policy response, China’s growth could decline by as much as 4 percentage points relative to the baseline projections. |

Ah, so a stimulus can save the day. And does China have sufficient room to enact another stimulus? The answer, according to the Fund, is a resounding ‘yes’ (emphasis is ours this time):

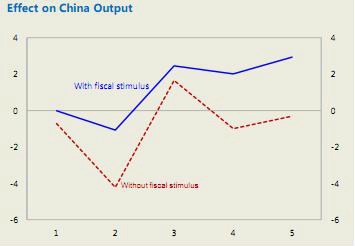

| A track record of fiscal discipline has given China ample room to respond to such an external shock. A sizable fiscal stimulus could mitigate, but not fully offset, the decline in its output. In particular, a front-loaded fiscal stimulus of around 3 percent of GDP spread out over 2012–13 would limit the growth decline to around 1 percent, cushioning the adverse effects on employment and people’s livelihoods. |

And a visual illustration of the Fund’s “with stimulus” and “without stimulus” scenarios:

|

Phew! So everything will be fine, then, provided that Beijing dusts off its chequebook once again, right? After all, according to the Fund’s estimates, a 1 percentage point reduction in Chinese GDP growth would see Chinese GDP grow by 7.2% in 2012 and 7.8% in 2013.

Not so fast. For while the Chinese government may indeed have ample scope for further stimulus, its leaders, still struggling to deal with the aftermath of the previous stimulus package, which unleashed a flood of credit and liquidity and burdened local governments with significant levels of debt. Here are some words of caution along these lines from a number of prominent China analysts, as told to Emerging Markets last September:

From Mark Williams, chief China economist at Capital Economics:

| Chinese policymakers still have the means – they still have control over the banks and a lot of fiscal policy room to act. But the appetite for that kind of grand stimulus is a lot weaker than it was back then because the risks are far better understood. |

Louis Kuijs, ex-World Bank and MF Global:

| In the event that a new downturn of similar magnitude were to occur, a scenario that is looking less and less hypothetical by the day, there is a fair risk that China’s response may not be as big as it was. That’s a risk that it’s right to be worried about. |

And Wang Tao of UBS:

| The government’s top priority is social stability, and lessons have been learned from the previous stimulus. Many people in China felt that, while the stimulus brought about very nice GDP growth numbers, it also had undesirable side effects – asset-price inflation, low-quality construction, social issues. These are still being felt, so I think that the government will be careful not to put too much emphasis on growth at the moment. |

Of course, should the eurozone crisis trigger a full-scale financial crisis in developed markets and China’s trade and GDP numbers fall off a cliff, then the government may well feel compelled to act, especially with the leadership transition occurring this October. But those expecting Beijing to act like it is 2008 all over again are liable to be disappointed. And if the IMF is right, the result could be significantly slower growth in China – and, therefore, by extension, a significantly deeper downturn worldwide. Hold on tight.