Correlation does not imply causation. But the IMF’s desire to grab Chinese cash to help monetize eurozone fiscal deficits boost its firepower could be seen, by some cynics, as linked to another announcement by the Fund this week.

| The International Monetary Fund is reviewing whether China's currency should still be considered "substantially undervalued," in light of its rapid rise in the past year. The review could take months, but if the IMF decides China's yuan is just "undervalued," that milder label could undercut U.S. efforts to challenge Beijing's currency policy in an election year. |

Go on:

| The IMF told the Group of 20 industrialized and developing countries last week the yuan's value climbed faster last year than in the past. The effective exchange rate, adjusted for inflation, based against a basket of currencies and accounting for inflation, rose more than 8% in 2011, and the annual rate of appreciation accelerated to almost 20% in the last three months of the year. The fund said the yuan still needs to appreciate more. But "since our last assessment in the summer of 2011, the [yuan] has certainly appreciated," IMF spokesman William Murray said in an interview. Asked whether that rise meant the yuan was still "substantially undervalued," Mr. Murray said the fund is "in the process of assessing China's exchange rate". |

The fact that the IMF - an institution created in 1945 to oversee global exchange rate regimes - needs to spend months to work out China’s exchange rate level, in both nominal and real terms, was explained thus:

| [The IMF is] conducting a pilot program using a new method to assess exchange rates that takes into account a country's size, its trade relationships and currency reserves. The board plans to review the new method for assessing exchange rates and current accounts before the annual IMF spring meetings. |

Ah yes, we remember now. The G20 in 2010 empowered the IMF to assess international economic policies and to provide “indicative guidelines” on how to generate sustainable balanced global growth. The eurozone crisis has taken the attention away from this mission somewhat. As well as being music to the ears of the leadership in Beijing, a potentially less critical IMF voice on Chinese currency policy might complicate efforts for US policy-makers – Republican and Democrat alike – to pass anti-China legislation.

But the reality is policy-makers – not just from the US – have been disenchanted with the IMF’s role in overseeing global currency regimes for years now.

Exit IMF, enter WTO

Somewhat ironically, in September Brazil proposed to the WTO a scheme whereby countries will be empowered to impose punitive sanctions on trading partners judged by the IMF to have distorted their exchange rates.

The proposal was aimed against the US’s QE policy, which it claimed was aimed at artificially depressing its currency to boost exports. In addition, the proposal was designed to beef up the WTO’s powers given the IMF’s perceived impotency on the issue. And the cause of using the WTO for exchange rate disagreements – against China – has most recently been taken up by Mitt Romney, the Republican presidential candidate front-runner.

And if the IMF reckons the Chinese currency, on a cyclical basis, is less undervalued than it was – even if it’s based on impeccable technical analysis – it could increase disenchantment with the IMF and increase the relative appeal of the WTO. Still, there are huge technical and political hurdles in beefing up the powers of that multilateral body.

For those that reckon the international trading system can be characterised by competitive devaluations of exchange rates, the principal weapon in trade protectionism, the IMF’s decision this spring will be crucial.

Finally, in recent months, the ideological mojo of right-wing Republican presidential candidates has been unleashed. And China’s export-led economic model has been one of the whipping boys.

For some edutainment and a sign of public policy discussions to come, here are a selection of clips:

Mitt Romney on China, Trade

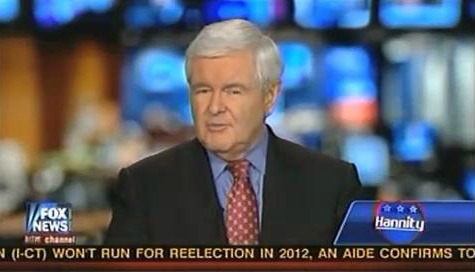

Newt: Don't Worry About China's Policies, Worry About America's

Trump to China: "Listen You Motherf***ers...."

Jon Huntsman on China