Prior to the 2008 financial crisis, regional trade evangelists were increasingly vocal in arguing that growing south-south and intra-regional trade links, in particular intra-Asian trade, could help to insulate the region’s exporters in the event of a downturn in demand from developed markets.

We all know what happened next. Global demand fell off a cliff, with Asia’s export manufacturing powerhouses suffering a dramatic slump in export volume and income, dragging down GDP. Policymakers and economists were surprised by how short the time-lag could be between financial market stress and trade volumes.

With the global economy teetering on the brink once again, and with a sharp slowdown in trade already visible in Brazil and, to a lesser extent, China and other Asian export economies, EM policymakers appear to be bracing themselves for a repeat performance.

But according to Brian Jackson, a senior Asia strategist RBC Capital Markets, Asian export economies are now better insulated against a slowdown in Europe and the US than they were in 2008-9. In other words, the long-awaited intra-Asian trade dream may finally be becoming a reality.

His argument: there has been a significant increase in final demand from within the region since 2008 that will provide far greater support for Asian exports than we saw in 2008-9, even in the event of a significant drop-off in demand from Europe and the US.

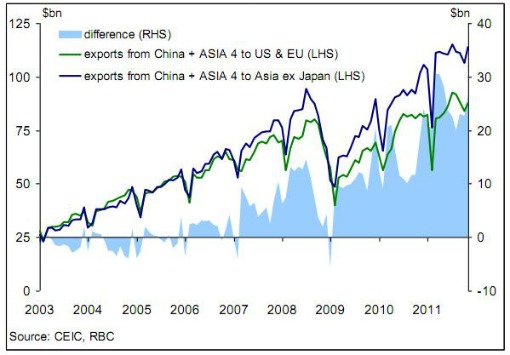

Jackson has calculated the total value of aggregate exports from China as well as from what he terms Asia 4 (South Korea, Taiwan, Hong Kong and Singapore) to Asia ex-Japan (i.e. intra-Asian exports), as well as aggregate exports to the US and EU combined. He found that the difference between these two aggregate export totals has increased significantly since 2008 (see chart below).

|

A number of analysts have pointed to trade numbers showing that the proportion of exports from China and Asia 4 to other Asian markets as well as to Latin America and other EM regions has grown, while the proportion of exports to the EU and US has fallen since 2008-9. But the counter-argument to this has been that this could simply reflect a shift in regional supply chains and the location of industry, rather than a shift in final export demand. Asian countries could simply be shipping parts to a neighbouring country for another stage of the assembly process, with that country then shipping the final product to Europe or the US.

But by calculating the difference in aggregate export totals, Jackson is able to show that the total value of Asian exports to neighbouring countries is increasingly outstripping the total value of Asian exports to Europe and the US, lending significant weight to the regional trade thesis.

Jackson writes:

| Major Asian economies are now exporting significantly more to their own region than they are, in aggregate, to the US and EU, with this amount averaging around $24 billion per month in 2011. This strongly suggests that much of the recent increase in intra-regional trade in Asia reflects stronger final demand from within the region rather than from the US and EU. |

This does not equate to decoupling, but it should lessen the blow for Asian exporters in the event of a significant slowdown in developed markets. He concludes:

| Asia is still vulnerable to weaker growth in the US and Europe, but this vulnerability is less pronounced than previously. |

Of course, this is positive for Asian exporters, provided that Asian final demand continues to grow. There is no evidence to the contrary in trade and macro numbers to date. But there are mounting fears that a number of fast-growing regional economies – China and Indonesia, to name two – face growing risks of a hard-landing, for domestic as well as external reasons. Should this happen at the same time as demand from Europe and the US undergoes a multi-year decline, then the prognosis would be very different. But given the raft of negative headlines out there, we should perhaps cross that bridge if and when.