Emerging markets, with Asia as their engine, have been the driving force pulling the world out of recession. GDP growth levels are high, current account balances healthy, debt levels manageable and companies growing rapidly.

Until recently, this compelling growth story was reflected in the strong performance of emerging Asia’s equity markets. Indonesia’s stock market climbed 46% in 2010, Thailand’s 41% and the Philippines 38%. Pakistan, Korea, Malaysia and India all topped 15%. Although China’s domestic market suffered a 14% reverse in local terms, most investors get their China exposure through the Hong Kong market, which climbed a modest but positive 5% last year.

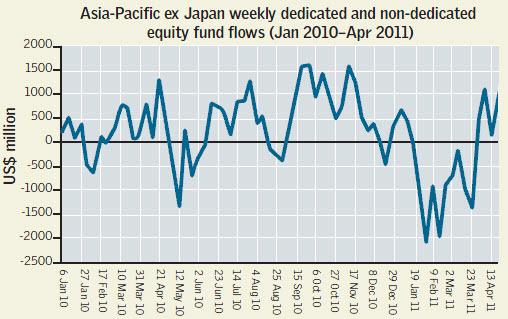

But while the economic growth story remains positive across much of the region, the outlook for equities has been much less rosy so far this year. According to data from fund flow tracker EPFR, Asia Pacific ex-Japan equity funds saw net year-to-date outflows of $6.2 billion as of April 20, compared with net inflows of $12.6 billion during the final three months of 2010.

Emerging Asia, the darling of world stock markets since the financial crisis, is suddenly out of favour.

“We are relatively cautious on emerging markets and prefer the US and Japanese markets,” says Schroders’ chief economist and strategist Keith Wade. Citi Private Banking chief investment officer Richard Cookson, in his April 12 briefing to clients, rated Asia ex-Japan equities “very underweight” relative to the previous month, encouraging the wealthy to trim allocations.

While the reversal of fund flows out of emerging Asian equities during the first quarter can in part be explained by concerns over stretched valuations, with inflation gathering pace across much of Asia and necessitating a policy response, expectations of monetary tightening also appear to be behind the recent sell-off.

But with EPFR data released on April 22 showing four consecutive weeks of inflows back to Asia ex-Japan equity funds, and with policymakers appearing if not on top of inflation concerns, then on the right track, the long-term outlook for emerging Asian equities appears robust, though investors are likely to remain cautious in the coming months due to existing and potential global shocks.

VEXING VALUATIONS

A number of analysts believe that, by the turn of the year, many emerging Asian equity markets were close to topping out. Deutsche Bank strategist Ajay Kapur, for example, says Asian equities are likely to underperform global equities in the near term. “For Asia to outperform, it would either have to see a bubble like 1993 or 2007, or see its return on equity – already at historically high levels – power ahead to record highs. I think that unlikely.”

Strong gains across emerging Asian equity markets last year, with some markets such as Indonesia rising to record highs, have left some appearing over-valued. “Institutional investors have started to be more concerned over the valuation of emerging equities, and this has been reflected in their reduced intention to overweight the market as well as the significant ebb in fund flows,” says Wade.

Wade points out that just because Asia has the best economic fundamentals, it doesn’t necessarily make it the best place to put money today. “The best sustainable growth prospects remain in the emerging world due to their stronger structural fundamentals, including current account surplus positions,” he says. “However, in terms of valuations, the discount between the emerging and developed markets is quite narrow, indicating some of the growth premium is already in the price.”

The trailing price to earnings ratio of the MSCI Pacific ex-Japan was a multiple of 17.9, slightly above the 20-year average of 17.5.

INFLATION CONCERNS

Valuations are only part of the story, however. With both headline and core inflation gathering pace across much of the region, concerns over the policy response have also been foremost in the minds of fund managers and investors.

“Rising inflation is becoming a major concern in Asia and other emerging countries,” says Shane Oliver, head of investment strategy and chief economist at AMP Capital Investors. “So far it’s largely due to higher food prices, and non-food inflation remains reasonably benign. However, with strong growth having used up excess capacity and monetary conditions remaining easy, a glow on to higher non-food inflation is a growing risk.”

Inflation is a particular worry in Indonesia, where rising prices have been fuelled by foreign inflows that accounted for 30.8% of all rupiah government bonds in January, pushing up asset prices and also raising concerns about sudden outflows. In that environment, inflation hit a 21-month high before Bank Indonesia raised rates in February, with the CPI having grown 7% year-on-year the previous month. Fitch, calling inflation “a near-term risk to economic prospects”, estimates it will average 6.5% in 2011.

Concern is growing that policymakers across the region will tighten monetary policy further, dampening the prospects for growth and stock market performance. “Further tightening is likely to be a continuing drag on the relative performance of share markets in Asia and the emerging world over the next six months, until it is clear inflation is back under control,” Oliver says.

China is also struggling to grapple with rising prices. Its most recent CPI release, while below Indonesia, showed a 4.9% year-on-year increase, higher than many expected. Deutsche Bank expects it to peak at 5.8% in June.

THE CENTRALITY OF CHINA

China’s trajectory is central to the Asian story. For now, few are concerned about the growth outlook, with consensus estimates at 9% growth for 2011 and 8.5% for 2012. But a robust growth picture does not imply a positive equity story: in 2010 China’s GDP grew by double digits while its domestic stock markets fell by double digits.

Should inflation continue to rise in China, prompting the government to raise interest rates and reserve requirements to the point where they trigger a hard landing for the economy, this would have a significant knock-on effect on other regional markets.

Although not its baseline scenario, Schroders outlines a case whereby emerging markets growth falls to 3.5% in 2012 following a sharp Chinese slowdown. Wade says he forecasts additional hikes in reserve requirement ratios and interest rates in China in the year ahead.

For now, though, the consensus remains broadly sanguine on China, perhaps helped by the fact that after falling for much of 2010, domestic A-share markets have bucked the regional trend by rebounding strongly in 2011. As of close of trading on April 22, the Shanghai Composite Index has risen 7.2% year-to-date, while Deutsche, which advises a medium weight to Chinese equities, has upgraded its forecasts for 2011 GDP growth to 9.4%.

Andy Rothman, chief China macro strategist at brokerage CLSA, says that the recent Chinese market rebound is a sign that domestic investors believe that the risks of over-tightening leading to a hard landing are remote, pointing out that A-share markets rose 1% on the day of the most recent rate hike on April 6, as opposed to market falls following the two previous hikes.

“The market reaction shows that there is a growing view in China that CPI is under control, and that the tightening process is pretty much done,” he says.

|

GLOBAL UNCERTAINTIES

On top of worries about inflation and Chinese growth sustainability, Asia’s economic fortunes remain tied up with those of the global economy. The idea of a decoupling between Asia and the world economy has been long since debunked – even if steadily rising domestic demand across the region makes the notion at least still plausible.

But Asia remains vulnerable to external shocks. Worries are mounting about the pace of US recovery, weakness in the eurozone (and in particular its sovereign debt woes), global liquidity tightening (money has historically fled emerging markets at times of stress), upheaval in the Middle East and a prolonged high oil price.

Many analysts believe that fears over oil prices and Middle Eastern unrest may well have driven some of the capital reversal out of emerging market equities during the first quarter, as investors retreated to safe havens. But, while concerns over possible contagion now appear to some extent priced into EM equities, analysts believe that the US and European outlook will continue to weigh on investor sentiment.

“We saw asset market rotation out of emerging Asia during the first quarter and, with the end of the second round of quantitative easing (QE2) in the US in June, we may still see a degree of rotation out of [the region] as a risk aversion play. Investors tend to avoid uncertainty first and ask questions later,” says Tai Hui, regional head of south-east Asian research at Standard Chartered.

AMP Capital’s Oliver does not believe that the end of QE2 will have a serious lasting impact on Asian equities, but says the real event to watch out for is when the Fed signals it is moving towards monetary tightening. Overall, he thinks that the impact of US debt concerns and policy tightening on Asian markets will be “somewhat ambiguous”.

“On the one hand volatility and nervousness around US bond yields will affect capital flows and regional asset markets generally, but on the other hand Asian markets may be seen as a relative safe haven as public debt is not an issue for most countries in Asia,” he adds.

BULLISH LONG TERM

Hui, like many analysts, believes that recent and future short-term outflows will prove short-lived. “Most clients we speak to continue to hold favourable views on growth and economic prospects in Asia,” he says. “They like the Asia story but think that the valuations in some countries are too expensive.”

Oliver shares this view. “Our cautious short-term stance on emerging market shares doesn’t alter their favourable strategic outlook,” he says. “Inflation in the emerging world is a long way from spiralling out of control, valuations are reasonable and Asian and emerging countries generally lack the debt constraints of major developed countries.”

A recent Barclays Capital survey of Asian wealth managers – with more than $5 trillion under management between them – showed that the wealth management constituency is also clearly keeping faith with Asia: 60% of respondents to the survey expected revenues to grow by more than 5% in Asia ex-Japan over the next two years, with China (where 54% expect 15% growth per annum or more) and India (where 40% expect that level of growth) leading the charge.

And fund managers are especially optimistic on the longer-term outlook. “There will be 300 million more workers in Asia in the next 10 years. The labour force in developing countries will shrink over the same period,” says Kerry Series, chief investment officer of Eight Investment Partners, an Asia-focused fund manager based in Sydney. “The Asia story is 60% of the world’s population reclaiming their share of wealth – getting back to where they have been for 18 of the last 20 centuries.”

But with the inflation battle far from won and with clouds continuing to loom over the global outlook, the short-term outlook for emerging Asian equities remains much less certain.