Bankers across Southeast Asia vaunt Nazir Razak for his incisive and savvy managerial skills. It will be interesting, therefore, to see whether the soon-to-be chairman of CIMB Group is up to the task of forging a new Southeast Asian banking champion.

On July 10 CIMB, RHB Capital and Malaysia Building Society (MBSB) announced that they were entering a 90 day exclusivity period to discuss a three-way merger to create “a mega Islamic bank”, after having received regulatory approval to do so. CIMB looks set to emerge as the dominant entity from a consolidation that, if successful, would supplant Maybank as Malaysia’s largest financial group.

The merger appears state sanctioned (state pension fund the Employees Provident Fund owns almost 60% of RHB Capital and 41% of RHB Capital), and quite possibly was initiated at the government’s behest.

“This merger was born from RHB and MBSB, given that the EPF is a major shareholder in each,” says the Asia head of financial institutions group banking at a leading global investment bank. “Technically merging the two is in violation of Bank Negara rules because EPF is deemed the shareholder controller of both institutions, so for it to go ahead it probably needed official sanction.”

It’s an interesting time for such a bold financial experiment to take place. Just two weeks before the three organisations revealed their plans, Razak had said he would move from being chief executive of CIMB to group chairman. Some wonder if it means he was told he couldn’t head this combined entity. However others note his respected status, and think it might be a means for him to better coordinate the compression of these three organisations into one.

The ramifications of the merger, if successful, could be greater outside Malaysia than in. A combined megabank would have the financial firepower to directly compete against Singapore’s three heavy hitters, DBS, OCBC and UOB.

Razak has long made his desire to make CIMB a truly pan-Southeast Asia bank, and this could make it so.

Economies of scale

The announcement of the three-way merger has some way to go yet. Price talk about the merger has remained quiet to date, but the merger would in all likelihood involve share swaps rather than much in the way of cash.

In the weeks since the announcement the market reaction has varied from being reasonably warm to concerned. Credit rating agency Moody’s was positive about the prospects of the tie-up.

“The merger would be credit positive for RHB and MBSB because their credit profiles would likely benefit from CIMB’s support and being part of a larger and financially stronger banking group,” said Simon Chen, an analyst covering financial institutions at the rating agency, in a report. “RHB’s standalone credit quality would also benefit from CIMB’s larger distribution network and stronger funding profile.”

Chen added that “the deal would also be credit positive for CIMB because it would enhance its scale of operations, although the extent of the benefits would depend on the execution of the merger and the transaction terms”.

However, others were shriller in their reaction. “The proposed merger of CIMB, RHB and MBSB is ambitious, and will bring inherent challenges and risks for the new banking group amid a complex integration process,” said Fitch Ratings on July 15.

A head of financials equity research for Malaysia at an international bank says it appears a sensible move, and one that is a natural progression of CIMB’s attempt to consolidate RHB in 2011. The move at that point was seen as being rather expensive, but the analyst notes that “if you look at the price it was willing to pay then and apply it today, it doesn’t appear so unreasonable”.

By and large, bank analysts feel the move could be successful, provided the banks don’t have their hands tied too much by politics. The key will be how long the three then take to integrate their services, and how aggressive they are able to be when it comes to cutting the inevitable overlaps that exist between them. The latter part is likely to prove the most complex.

Building a banking beast

Combining CIMB, RHB and MBSB would make for a powerful institution.

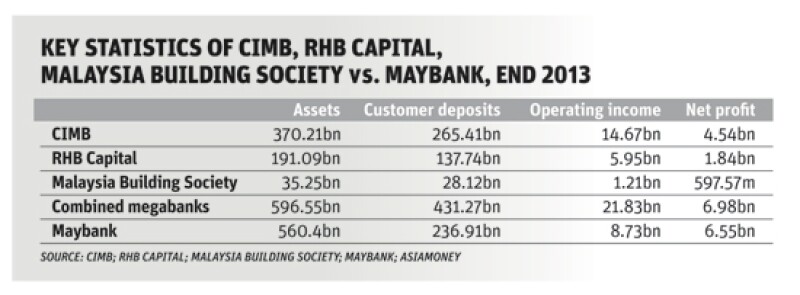

CIMB boasted an operating income of MR14.67bn ($4.62bn) in 2013 and a net profit of MR4.54bn for the financial year, off the back of MR370.21bn of assets and MR265.41bn in customer deposits. Its cost to income ratio of 57.6% is a little high but the bank has been continuously expanding, so this isn’t entirely surprising.

RHB had total assets of MR191.09bn at the end of 2013, customer deposits of MR137.74bn, it made an operating income of MR5.95bn and a net profit of MR1.84bn for the financial year. Meanwhile MBSB reported total assets of MR35.25bn at the end of 2013, MR28.12bn of customer deposits, revenue of MR2.54bn, operating profit of MR1.21bn and net profit of MR597.57m.

Theoretically, a megabank of the three would have assets of MR596.55bn, MR431.27bn of customer deposits and a net profit of MR7.59bn for 2013.

This would outweigh Maybank. It reported MR560.4bn of assets at the end of 2013, customer deposits of MR236.91bn and its net profit was MR6.55bn.

However Maybank’s cost to income ratio at the end of 2013 was 47.8%, far lower than CIMB’s, and something the combined group will want to emulate. It’s also likely to prove the biggest point of contention.

Maybank and RHB in particular have some hefty overlaps, particularly when it comes to their branch networks. It would make sense for a combined bank to shutter a set of branches that lie too close to each other, saving money on staff salaries, rent and other costs. But that’s likely to prove politically difficult. The group would probably have to slowly conduct such cuts, diminishing the potential cost savings.

There is also another possible headache: the Abu Dhabi Investment Authority. It holds a 20% plus stake in RHB, and may prove willing to remain a passive shareholder in a bigger institution it may not.

“ADIA’s interests do not necessarily align with Malaysia Inc’s,” says the head of FIG banking. “How it reacts to this could have a disproportionate impact on the outcome.”

Potential on offer

If it goes ahead, the merger offers sizeable opportunities. Daniel Tabbush, an independent bank research analyst who used to head CLSA’s bank research team, believes MBSB could provide the crucial leg of the merger.

“Maybank has funding costs of around 150bp-220bp (basis points), whereas the others’ costs are 215bp-220bp. Once CIMB have a combined entity and rationalise some of the branches they can build their retail deposit base and that will cause funding costs to go down. That’s a huge potential quantum,” he says, estimating the merger might allow the combined entity to cut its funding costs by 15% to 20%.

A key part of this would be the inclusion of MBSB. CIMB and RHB are largely corporate-focused, offering around 65%-70% of loans to companies. About 90% of MBSB’s lending goes to retail customers. Tabbush says that including MSBB into the merger brings the average weight of corporate lending in the combined entity down to under 50%, a far healthier margin. That would cut its funding costs.

And the new bank could quickly expand its retail franchise too, given that it will possess a far bigger branch network than MBSB possesses. “MBSB has about 50 branches, whereas the new institution would be far larger,” he says. “Once MBSB is able to write mortgage loans at 500 branches instead, it will quickly grow.”

There are other potential advantages of the three-way merger too, such as cross-selling products to each other’s clients.

A question of growth

Building deposits will be important in order to support increased lending activity. And so will adding capital to the combined bank.

Neither CIMB nor RHB are particularly well capitalised. Under Basel III applicable guidelines, the former had a capital adequacy ratio (CAR) of 12.9%, of which its core tier one ratio was 9.6%. RHB’s CAR was 14% with core tier one of 11.1%. In comparison, Maybank had a CAR of 15.66% and a core tier one ratio of 11.25%, while regional Singaporean bank DBS boasted a total CAR of 16.3% at the end of 2013, while its tier one stood at a much stronger 13.7%.

The combined bank will likely need to bolster its tier one capital ratio in particular if it is to ease any worries from observers, and particularly if it intends to expand lending into both retail and overseas. That could mean potential preference share or rights issues shortly after the merger.

The fallout is likely to be relatively contained upon Malaysia’s local banking sector, which has already gone through several rounds of consolidation. The FIG banker notes that some conspiracy theorists believe the merger will pressurise Maybank to snap up a local player to regain the mantle of largest bank. The most likely target would be AmBank, as the other candidate, Public Bank, would be too expensive.

He is less certain it would want to do so. “Maybank is on a good run as it is, with a good growth trajectory and better profit numbers than CIMB. Buying AmBank would prove disruptive; I don’t think it would necessarily want to do so.”

Maybank’s other alternative would be to look offshore for a purchase to bolster its size. Indeed, the bigger effect of the three way merger could end up being felt across Southeast Asia.

Razak, who declined to respond to detailed questions from Asiamoney, has long wanted to build an institution with genuine heft and the capability to grow across the Association of Southeast Asian Nations (Asean). He previously expressed his belief to Asiamoney that the future of CIMB lay increasingly outside Malaysia, and the bank would eventually seek to source more revenue from Indonesia, where it owns a majority stake in CIMB Niaga, than at home.

This home-based merger might appear at some odds against such ambitions, yet by establishing such a strong home base Razak will have the asset heft to truly start supporting intra-Asean lending and trade finance on a larger scale. That’s a good place to be in ahead of the region’s adoption of the free trade area at the end of 2015. It could also mean Malaysia creates another pan-Asian financial institution, alongside Maybank.