Americas

-

Axtel, the Mexican telecoms company, is meeting investors for a planned senior unsecured bond issue. Investors say the firm is almost unrecognisable from the one that carried out a distressed debt exchange in 2013.

-

Holders of PDVSA’s 2017 bonds were suddenly filled with dread by Tuesday’s close as rumours of the overdue maturity payment being made could not be confirmed. Its credit default swap price worsened on the expectation a credit event would be declared.

-

Public sector borrowers have crammed more dollar deals into Tuesday than are sometimes seen in a week. But far from suffering from too much choice, investors gobbled up everything on offer — and bankers expect them to do just the same for two deals on Wednesday’s menu.

-

A high stakes game of chicken is taking place between US and European regulators, with the spectre of fragmentation in derivatives markets looming. But there's been no proper dialogue between the two sides.

-

Bunge Finance Europe, an arm of the US agricultural commodities group, launched a revolving credit facility on Tuesday to refinance a $1.75bn loan from 2014. Fourteen banks have joined before general syndication.

-

The head of the foremost derivatives regulator in the US, Christopher Giancarlo, has issued a warning to European regulators on incoming regulation, condemning “costs and regulatory burdens” to the US economy.

-

While it is tempting to think of capital markets-friendly President Mauricio Macri as having wiped Argentina’s slate clean, it is not yet time for EM investors to forgive and forget.

-

Panamanian lender Multibank sold $300m of five year bonds on its first US bond market outing on Monday.

-

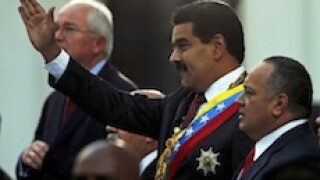

President Maduro’s surprise restructuring announcement only makes things murkier for Venezuelan bondholders.

-

Rentenbank will tap a resurgent long end dollar market on Tuesday, alongside a rare appearance in the currency from the Canadian sovereign in fives and a French agency in threes. This is only the second time in nearly two and a half years that issuers have peppered the whole of the dollar curve on the same day.

-

The trend for corporate issuers in 2017 has been to sell bonds with longer tenors, but in among a five deal issuance spree on Monday was a couple of two year floating rate notes from rare issuers.

-

On Monday, Whirlpool became the fourth US issuer to use the euro corporate bond market in the last 15 days when it sold a €600m 10 year deal, 12 months after it last visited the market.