Americas

-

SSA bankers looking to get their Christmas shopping in early were in a slight state of shock on Tuesday, as World Bank lined up a dollar deal to follow a Canadian province’s return to the currency after a six year hiatus.

-

Brazilian bank BTG Pactual will buy back 30% of its existing perpetual bonds after strong participation by affiliates of the lender that hold the notes.

-

Brazil’s largest private sector bank Itaú is set to price its first Basel III-compliant hybrid perpetual note on Tuesday after setting initial price thoughts that bankers away from the deal described as “promising” for the borrower.

-

A raft of issuers from the US energy sector swarmed the leveraged loan and high yield market on Monday, overcoming a brief hiccup in the market that caused three energy issuers to pull deals earlier in the month.

-

Brazilian meatpacker Minerva will wrap up investor calls on Tuesday as it plans a deal to finance a tender offer for existing bonds.

-

The Chicago Board Options Exchange on Monday said that it would launch bitcoin futures on December 10, more than a week ahead of competing exchange operator Chicago Mercantile Exchange Group.

-

Royal Bank of Canada not only found good demand in a larger than average size for its five year sterling covered bond on Friday, but also executed the trade at considerable cost advantage compared with dollars and euros.

-

Friday’s sharp turnaround in US sentiment left some European corporate bond players unsure as to how their market might open on Monday. But the tone turned out to be positive and US chemicals company Celanese Corp was ready to take advantage.

-

Alpha Holding, which specialises in consumer and SME lending in Mexico and Colombia, has named leads for a dollar bond.

-

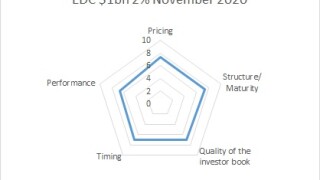

The votes have been counted and the results are in. The BondMarker voters have delivered their verdict on the Export Development Canada (EDC) benchmark

-

CME Group, CBOE Futures Exchange and Cantor Exchange have all self-certified bitcoin derivatives contracts with US regulator the Commodity Futures Trading Commission.

-

Banco Votorantim kicked off a run of issuance from Brazilian banks with a Basel III-compliant additional tier one perpetual non-call five deal on Thursday.