Americas

-

The Reverse Yankees are coming, but the market looks much better for Europeans headed the other way

-

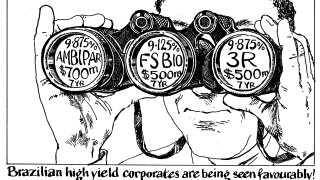

Make way for the Latin American high yield companies that put the 'emerging' into EM bonds

-

◆ New York Community Bancorp reports loss and shares tank, prompting fresh fears for health of regional banks ◆ January ends strong month for US FIG issuance ◆ European Yankees expected to return from next week

-

The US high grade market has had its busiest start to the year ever

-

Latin American corporate issuance comeback has beaten the expectations of some investors

-

Bankers disagree about whether fatigue for 10 year deals is growing

-

Oil and gas junior becomes LatAm's first debut issuer of the year with Ambipar to come

-

◆ US FIG January volumes reach $112bn ◆ Highest month ever within sight ◆ Bank of New Zealand the sole Yankee issuer this week

-

Lockheed Martin led a busy week for US high grade issuance

-

Overwhelming demand has led to an unusual upsizing of a no-grow deal this week

-

Foreign investment in Israel ground to a halt when the war with Hamas began in October

-

Appetite for 30-year strong as LatAm’s largest sovereign notches its biggest new money trade