Americas

-

The run of new bond issues from Latin America credits looks set to extend this week after the slew of corporates from the region to tap the market last week mostly emerged with a combination of slim new issue concessions and positive aftermarket performance.

-

Electric vehicle maker Li Auto is planning to float American Depository Shares (ADS) on the Nasdaq. It is eyeing $100m in proceeds.

-

Each week, Keeping Tabs brings you the very best of what we have found most useful, interesting and informative from around the web. This week: liquidity in the age of central banks, making bank capital green, and US fiscal stimulus.

-

After striking a remarkably swift restructuring deal with creditors, Ecuador’s government deserves praise. But it is unrealistic to expect such smooth discussions elsewhere, as emerging market sovereign defaults inevitably rise.

-

Latin America has been taking the spotlight in July after a record-breaking quarter for emerging markets bond issuance, but with US elections looming and all-in yields still very attractive, bankers across the emerging market world say there are plenty of reasons for issuers to continue to flock to markets.

-

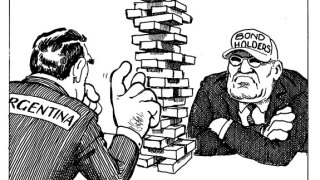

Amid warnings about a looming debt crisis in emerging markets, bond investors this week hailed Ecuador as an example to follow in sovereign restructurings, while continuing their showdown with Argentina. Ecuador’s market-friendly philosophy appears to be paying dividends over Argentina’s more confrontational approach, but not every issuer is likely to follow its precedent, writes Oliver West.

-

US corporate bond issuers got straight back to business after the July 4 weekend as 11 borrowers raised $10.8bn, though the volume of issuance is tapering off as companies head into earnings blackouts.

-

Japanese duo Mizuho and Nomura both hit the market with new issues on Monday as the primary market re-opened on a positive note following the July 4 holiday weekend.

-

Philip Brown and Sanaa Mehra are leading a new unit at Citi, the latest the bank has designed for its sustainable finance business.

-

Argentina’s largest bondholders on Wednesday evening dashed hopes that the government’s new improved restructuring offer would achieve mass take-up. But some investors took hope from the tone of the creditors’ statement.

-

El Salvador, the highest yielding Latin American sovereign not to have already announced a debt restructuring, sold $1bn of 32 year bonds on Wednesday but at a hefty concession to its inverted curve.

-

Two Colombian companies kept corporate issuance from Latin America ticking with aggressive deals on Wednesday even as bankers reported softer conditions in US investment grade bond markets