Americas

-

Société Générale has hired Stephane About from Natixis, where he held a senior role in the Corporate and Investment Bank.

-

The New York Stock Exchange has dropped plans to delist the stocks of China Mobile, China Telecom Corp and China Unicom (Hong Kong).

-

Chinese clinical-stage company Gracell Biotechnologies has kicked off the roadshow for its Nasdaq listing, eyeing up to $158.9m in proceeds.

-

Mexico reopened the international bond market for EM borrowers on Monday by issuing the first Formosa bond from a Latin American sovereign in response to interest from Asian investors.

-

Brazil paper company Klabin began calls with investors on Monday as it looks to become the second Brazilian company to sell a sustainability-linked bond. The size of the potential coupon step-up differs depending on which of three sustainability performance indicators Klabin might fail to meet.

-

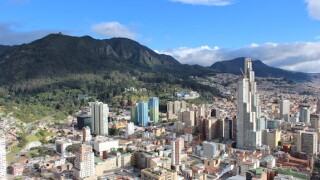

Banco Santander has become the 14th primary dealer in the domestic Colombian government bond market, said the finance ministry, representing the first expansion of the sovereign’s market makers since 2016.

-

Latin America’s largest e-commerce company, MercadoLibre, has mandated five banks ahead of a debut bond offering that will include one tranche of sustainable bonds.

-

Mexico returned to familiar territory by becoming the first Latin American borrower of the year to issue bonds on Monday. The format, however, was less familiar, as the 50 year SEC-registered $3bn bond — launched at around 11am New York time — will be listed on the stock exchanges of both Luxembourg and Taipei.

-

Growth stocks are overvalued relative to value stocks, according to Ben Inker, head of asset allocation at GMO. But in fixed income markets he is less convinced of a bubble, with central banks compressing yields.

-

Canadian issuers are expected to concentrate on building their regulatory buffers in 2021 mainly with dollar senior issuance with bankers suggesting that analysts’ covered bond supply forecasts for next year, which are considerably above €10bn, are overly optimistic.

-

The US stimulus package seemed all but a done deal until Tuesday night. The $900bn, 5,593 page bill was passed by both houses and requires only President Donald Trump’s signature to become law. Though this seemed a foregone conclusion, Trump is threatening to withhold his signature unless the size of the relief is increased, not that bond markets seemed fazed by the late upset.

-

Gol, Brazil’s largest domestic airline, has priced a $200m six year private placement. This is one of the first deals from a Latin American airliner since the pandemic struck, and comes after a number of peers in the region have fallen into bankruptcy.