Americas

-

Royal Bank of Canada issued a tightly priced €1.25bn 10 year covered bond on Tuesday. While it only attracted just enough demand for it, the long tenor, investor diversification, cost of funding and deal size were positives for the borrower.

-

Primavera Capital Acquisition Corp, a special purpose acquisition company, is set to launch a $300m IPO on the New York Stock Exchange this week, extending a recent boom in Asia-focused Spacs.

-

Creditors of Argentine state-owned oil and gas company YPF are fighting for their rights after being asked to participate in a debt exchange that would cause them material losses. But even if bondholders rebuff what appears to be an opportunistic offer, the attempted deal is another bad omen for investors in Argentina.

-

Chile is looking to debut its social bond framework in the euro market this week with a 20 or 30 year benchmark. The deal will be accompanied by a re-opening of its 0.83% green bonds maturing in July 2031.

-

A group of investors holding more than a quarter of YPF’s $6.228bn of outstanding international bonds have confirmed that they will not participate in the company’s exchange offer, but say they do not believe they need to take further steps, for now, to block the deal.

-

Peter Enns, most recently global co-head of advisory and investment banking coverage (AIBC) at HSBC, is set to be the next chief financial officer at insurer Chubb.

-

Chinese e-cigarette manufacturer RLX Technology has drawn enough early demand to well oversubscribe its US IPO worth up to $1.16bn, according to a source familiar with the matter.

-

Banco do Estado do Rio Grande do Sul (Banrisul), the 10th largest bank in Brazil, is approaching international bond investors for the first time since 2012 as it looks to return to markets with a tier two bond issuer.

-

Credit Suisse has promoted Ted Michaels, its head of North America renewables in New York, to a new global position overseeing investment banking in renewables and sustainable energy technology.

-

This week in Keeping Tabs: a key weekend for Germany's future, and Biden's stimulus plan.

-

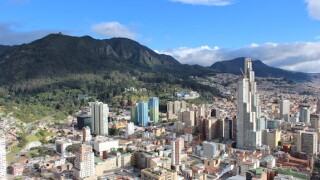

Colombia’s public credit head told GlobalCapital that the sovereign had wanted to move quickly to get ahead of potential volatility as it printed $2.84bn of new bonds this week as part of a liability management operation. The official said that the early-year sell-off in US Treasuries had not tainted what was a strong issuance window.

-

Four heavily oversubscribed Latin American new issues fetched tight pricing on Thursday, dispelling the unease felt at the week’s start and putting the region firmly on track to fulfil the predictions of record primary volumes for a January.