Americas

-

7-Eleven capitalised on huge investor demand to issue its first dollar bond this week, printing the largest US corporate deal of the year so far.

-

Sustainable bond issuance has made its strongest start to the year ever, thrusting the market towards what most observers believe will be a year when many records will be broken — especially in north and south America, where environmental and social consciousness is rising. Jon Hay, Mike Turner and Oliver West report.

-

HSBC appoints two within AIBC — Credit Suisse Asset Management hires head of origination in direct lending — Richard Luddington joins Rothschild

-

US equity markets suffered their worst single day since October on Wednesday, as equity investors reacted to growing concerns over stock valuations and fears of Covid-19 vaccine disappointment. Equity capital markets bankers hope that investor sentiment will hold for new deals, even if global markets take a turn for the worse. Sam Kerr reports.

-

GlobalCapital is delighted to announce the nominees for this year’s Americas Derivatives Awards.

-

The GameStop short squeeze has cost institutional investors billions. I’ll feel more sympathy if they’d occasionally pay for their drinks.

-

Casino operator Genting New York priced a $525m bond on Wednesday.

-

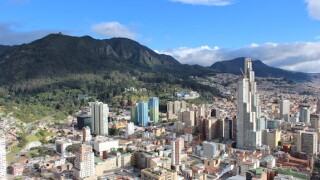

Colombian state-owned oil and gas company Ecopetrol said it would issue new debt and equity to fund a proposed takeover of the government’s 51.41% stake in conglomerate ISA (Interconexión Eléctria), should the finance ministry accept its offer.

-

Malaysia-based Catcha Group is floating a southeast Asia-focused special purpose acquisition company (Spac) on the New York Stock Exchange.

-

Latin American development bank CAF (Corporación Andina de Fomento) will pick either a five or seven-year maturity this week as it prepares its first benchmark in euros since May 2020.

-

Argentine oil and gas company YPF’s bonds rallied on Tuesday as markets acknowledged several improvements to terms on the company’s attempt to exchange all of its $6.228bn international bonds for new notes. But analysts were still undecided as to whether the amended offer would be enough for YPF to meet the necessary acceptance thresholds.

-

Mexican financing and leasing company Unifin Financiera returned to bond markets on Monday for the first time in 18 months, garnering sufficient demand to push the yield on its new $400m eight year into single digits.