Americas

-

-

Asset class war breaks out as FIG market complains Reverse Yankees are stealing investors away from their deals

-

Issuer takes size at a competitive price on first foray into Swiss francs

-

◆ Each issuer prints larger deal than usual ◆ NWB comes after BNG five year ◆ Quebec gets huge book

-

◆ US companies Pfizer and McDonald’s raise euros ◆ Pfizer pays zero concession but some thought it looked cheap ◆ McDonald’s cooks up almost €4.7bn book at peak

-

Canadian borrower mandates for deal ahead of what is forecast to be a big week for issuance volumes

-

Federal Reserve kept rates steady but only one company emerged after FOMC meeting

-

◆ Handful of European banks go Stateside after quarterly earnings ◆ Some revisit dollar funding despite it not offering best relative cost ◆ HSBC goes for size as its triple trancher surpasses BofA's $5bn print

-

◆ Triple tranche trade finds mixed demand ◆ Shortest tranche lands inside fair value ◆ 'Significant' demand for high rated short end to park cash

-

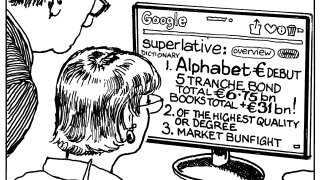

Google owner returns to dollar market for first time since 2020 for joint tightest 30 year spread ever

-

Fiserv and Visa print across the curve with more tipped to come

-

◆ Books bulge for three year deal ◆ Sizes and new issue concessions reflect demand differences ◆ Trade comes amid major data dumps