Americas

-

David Flechner returns to law firm after three years and will split time between São Paulo and New York

-

Argentine province already has the approval of 63.7% of its bondholders

-

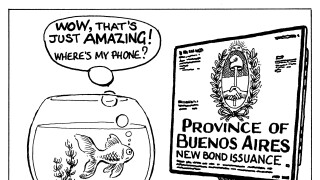

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories

-

Investors say dollar bonds yet to fully price in uncertainty

-

Bankers say Chilean issuers will dominate early autumn supply from Latin America as Alfa Desarrollo eyes $1.2bn bond

-

Argentine power company will issue $366m of green bonds as part of debt exchange

-

Moody’s says Colombian oil company faces higher leverage and refinancing risk due to its more aggressive financial policy

-

Argentina’s largest province notches 98% approval for its bond exchange, meaning new 2037 issue will surpass $5bn

-

Brazilian oil giant’s net debt to Ebitda ratio is at lowest level since 2011

-

California-based but Chennai founded software-as-a-service provider targets Nasdaq

-

Provinces of Buenos Aires and La Rioja secure creditor approval but limited impact on sovereign outlook

-

Latin America’s primary bond market has been eerily quiet this month. Risks of a bout of September indigestion are high