Covered Bonds

-

The European Banking Authority published its first comprehensive overview identifying the key features and practices of a prudentially sound covered bond market on Tuesday. The report provides advice to other regulators on the conditions that would justify the market’s continued preferential risk weight treatment.

-

Canadian Imperial Bank of Commerce recently updated its covered bond prospectus, giving rise to speculation that it could return to the covered bond market this year. CIBC is only one of two Canadian banks that have not issued in euros in 2014 and was last seen in the market in July 2013.

-

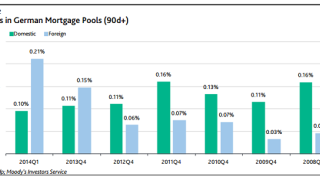

Arrears in foreign assets backing German mortgage Pfandbrief increased by 40% in the first quarter of 2014, according to Moody’s, although the share of foreign mortgages in Pfandbrief cover pools is on a steady decline.

-

Banca Monte dei Paschi di Siena’s (MPS) covered bonds’ outperformed the market on Monday after Moody’s upgraded them from Ba1 to Baa3 following the European close on Friday. The new rating more than halves the capital charge as the bonds move into investment grade territory, opening up demand to a much larger investor base. This swell of new interest should ensure that MPS outperforms the market over the summer.

-

Flows were mostly focused on buying of peripheral national champions on Monday, as the impending liquidity injection from the European Central Bank is expected to crimp supply prospects by more from these regions. This is especially the case in multi-Cédulus where RBS research picked 10 prospective deals that may outperform. In the primary market, talk was focussed on the wrapped collateralised debt obligation being marketed to covered bond investors until Tuesday by Goldman Sachs.

-

Well done Goldman Sachs, you’ve managed to devise a structure that has both the covered bond market and the ABS market talking at the same time. The covered bond market seems to have adopted the attitude that ‘imitation is the sincerest form of flattery, just don’t try to pass it off as a real covered bond’. The ABS market seem to have adopted an ‘anything the covered bond market can do..’ attitude.

-

Banks that have held a leading market share of the covered bond business are also dominant across all liquid fixed income markets. Being German helps, but those institutions that offer genuine added value in terms of trading and advisory services have performed consistently well. The Cover examines the driving forces between the winners and losers in covered bonds.

-

Since Goldman’s FIGSCO (Fixed Income Global Structured Covered Obligation) trade hit the screen, capital markets commentators, The Cover included, have been scratching heads and stroking beards about what it actually is.

-

Toronto-Dominion Bank could become the next Canadian bank to issue a covered bond after it received regulatory approval from the Canada Mortgage and Housing Corp (CMHC) this week. The sign off comes weeks after Canada set out guidelines on the liquidity coverage ratio.

-

Goldman Sachs may have been hoping that it could get away with calling its newly structured triple recourse hybrid a covered bond. Though it is being marketed to covered bond investors, FIGSCO is clearly nothing like a classical covered bond. But Commerzbank, NIBC and NordLB all encountered controversy when they successfully issued innovative deals, suggesting the clumsily named acronym may be a success – especially in an environment of furious yield chasing and a shrinking triple A universe.

-

The long end of the covered bond market has outperformed for many months, but even more so over the last two weeks. Bankers expect the rally to continue even though yields are now approaching their lowest in five years, and a point where major trend reversals have previously taken place.

-

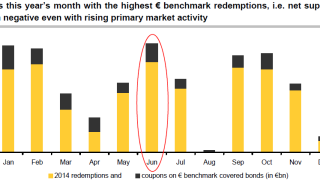

A week of no new issues in the covered bond market has confused some market participants, coming straight after the second busiest week of the year. But, at quarter end and with holidays around the corner, banks’ decisions over participation in the ECB’s targeted longer-term refinancing operations (TLTRO) programme — coupled with anticipation of a liquidity coverage ratio (LCR) announcement from the EBA— may be what is muting primary issuance.