Covered Bonds

-

Fitch has improved transparency in its latest covered bonds surveillance snapshot that now includes information on the base case portfolio loss rate (B PLRs). Cypriot, Greek and Spanish deals are the riskiest in the peripheral Europe while Danish, Belgian and Dutch are the riskiest mortgage programmes in core Europe.

-

Covered bonds have taken results of the European Banking Authority’s (EBA) stress tests in their stride with the most vulnerable deal of all widening just three basis points on Monday. Borrowers are expected to return to the primary market this week or early next, ahead of the European Central Bank’s November meeting and US Non-Farm Payrolls. In the meantime, the ECB announced it had bought €1.7bn of covered bonds from Monday to Wednesday last week.

-

The Spanish Treasury’s proposal for a new covered bond regime would lead to lower over-collateralisation, and so is credit negative, said Moody’s on Monday.

-

The Spanish covered bond law could be set for profound change that will bring it into line with the best in show schemes. Proposals set out on Wednesday by the Spanish treasury tie into capital requirement regulations and will become unstoppable under their own momentum. The major challenge is not that investors will have less collateral protection but rather the transition process itself. Grandfathering existing deals isn’t a viable option, there would need to be a huge debt exchange of all existing bonds for new ones or a fundamental change in terms and conditions.

-

The Spanish Treasury is proposing to change the country’s covered bond legal framework and on Wednesday asked for feedback from stakeholders by November 24. The move may result in a new regime in which bonds are backed by a tightly defined indexed pool of ring fenced homogenous assets. Though this will result in less collateral, a vast improvement in the quality is likely.

-

Coventry Building Society returned to the covered bond market for the first time in three years to take advantage of better market conditions than those that prevailed mid-week, and execute a trade before Sunday’s Asset Quality Review and stress test results are out, which could potentially disrupt the broader FIG market. Though there was some sensitivity in the book, the small deal size meant it was able price 2bp inside the tight end of initial guidance, an achievement that would have been unlikely with a €1bn trade.

-

The Spanish covered bond law could be set for profound change that will bring it into line with the best in show schemes. However, as the claim of existing holders would be considerably diminished, a huge liability management exercise is justified.

-

Spain’s new covered bond law, if passed, will mean a vast improvement in the quality of the country’s covered bond collateral – but could come at the expense of holders of the old bonds, who will find their deals backed by a dwindling pool of poor quality loans, unless they exchange into new deals.

-

Fitch put the AA+ rated covered bond programmes of Caisse Française de Financement Local (Caffil) and Compagnie de Financement Foncier (Coff), and the public sector programme of BNP Paribas, on rating watch negative (RWN) last Friday (October 17), following identical action on the French sovereign earlier in the week.

-

Standard & Poor’s has followed Moody’s in saying that a Swedish proposal to cap new interest-only loans at 50% of a property’s value, rather than the 75% maximum in force today, is credit positive. This is because it will lead to a lower mismatch between an issuer’s assets and liabilities, the main source of rating volatility for Swedish issuers.

-

The primary covered bond market picked up after a week without any issuance, just as the European Central Bank’s third covered bond purchase programme (CBPP3) got underway. All four deals issued this week were ineligible for the programme which, from a pricing perspective, made more a difference than their preferential treatment under newly established liquidity rules.

-

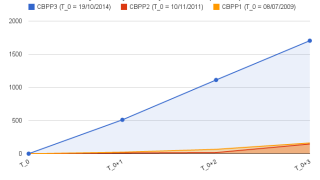

The European Central Bank is estimated to have bought well over €1bn, and possibly close to €2bn, in the first week of its third covered bond purchase programme (CBPP3) and traders have reported a tripling of flows. But limited dealer inventories are finite and issuance prospects mean it can only be a matter of time before the programme peters out, writes Bill Thornhill.