Covered Bonds

-

Covered bond bankers could soon be dealing with a new issuer if plans to separate the Norwegian business of SkandiaBanken AB go ahead. Moody’s has assigned a provisional Aaa rating for the new entity which will be known as Skandiabanken Boligkreditt AS.

-

A member of Royal Bank of Scotland’s covered bond and SSA research team has left the bank.

-

Euro benchmark covered bond year-to-date supply is the lowest in the last decade as a series of macro events, combined with banks’ increasing focus on bail-in, have kept activity to a minimum.

-

ING Bank is looking to exchange over €17bn of its covered bonds to soft bullet format having announced a consent solicitation on Monday morning.

-

Westpac NZ is marketing a new euro-denominated covered bond as another China-related sell off kept primary activity to a minimum on Monday.

-

ING Bank has updated its prospectus for the second time this year enabling it to issue soft bullet covered bonds. Analysts at ABN research believe this could be a precursor to a hard to soft bullet exchange.

-

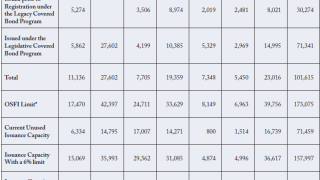

The Canadian covered bond issuance cap of 4% of total bank assets is lower than most other countries and should be raised, according to Finn Poschmann at independent Canadian research institute, C.D. Howe.

-

Banca Popolare di Milano (PMIIM), has mandated leads to market a covered bond from its newly structured shelf, which is rated A2 with Moody’s only.

-

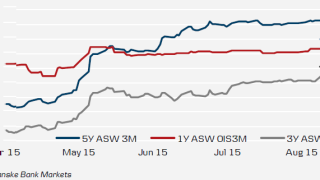

Danish covered bond auctions this week attracted strong demand, especially in the five year tenor where yields are double what is available in the eurozone.

-

Banco Popolare (BPIM) has obtained the approval of investors to remain the account bank on its own covered bond programme, even though this will result in those covered bonds being downgraded to a sub-investment grade rating.

-

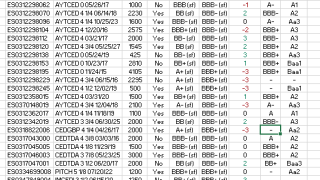

Standard and Poor’s has implemented its new rating method for Spanish multi-Cédulas programmes and announced a series of rating upgrades, downgrades and affirmations on the 32 deals it rates. The rating action should lower capital charges on some weaker deals.

-

The Danish summer auctions, which began on Monday, have attracted very good interest, especially in the five year tenor, which looks attractive on an outright yield and spread basis, particularly compared to what is on offer in the eurozone.