Covered Bonds

-

Canada’s Office of the Superintendent of Financial Institutions (OSFI) could allow the country’s banks to issue more covered bonds. The supervisor will begin a consultation this year which may lead to a change of the 4% limit on covered bond issuance.

-

Compagnie de Financement Foncier had been expected to open books for the first covered bond of the week on Wednesday but postponed the deal as market conditions deteriorated. Apart from the unfortunate timing, rival bankers said the long tenor was the wrong choice for the weak market.

-

FMS Wertmanagement has launched two separate tender offers on the Irish Stock Exchange for euro, swiss franc, US and Canadian dollar denominated covered bonds issued by DEPFA Bank and DEPFA Pfandbrief Bank SA.

-

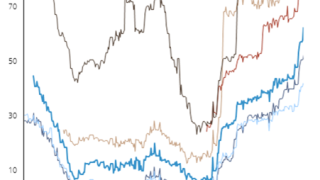

Spreads on covered bonds from Italy’s weaker credits have shot skyward this week, with indicative bids in the worst affected names out by at least 25bp since the start of the year. The moves have followed renewed concerns over their non-performing loans.

-

Compagnie de Financement Fonciere is expected to open books for a euro benchmark covered bond on Wednesday, which in light of market turbulence and the long 10 year tenor, may need to offer a tempting initial concession. Market conditions permitting, another issuer could brave the market with an alternative offering.

-

The supply outlook for covered bonds issued by well rated borrowers in Europe’s core and issues outside the eurozone is constructive, particularly in the defensive three to five year area, bankers told The Cover on Monday. However, with demand for peripheral supply less assured, the supply outlook for all but the very best names is set to remain challenging.

-

South Korea’s Kookmin Bank has selected four banks to run a potential return to the covered bond market, but a source at the issuer said that due to unfavourable market conditions, there’s a possibility that the deal will not materialise.

-

Virgin Money's prime UK RMBS Gosforth Funding 2016-1 was priced on Friday and attracted strong demand across all three currencies on offer. Further RMBS supply is expected from UK and Dutch issuers.

-

South Korea’s Kookmin Bank has selected four banks to run a potential return to the covered bond market, but a source at the issuer said that due to unfavourable market conditions, there’s a possibility that the deal will not materialise.

-

Covered bonds issued this week from Lloyds and Bank of Nova Scotia were among the largest seen this year and attracted the biggest order books.

-

Five issuers from core Europe priced covered bonds this week but the standout success, which could have been priced without the European Central Bank’s help, was the first Austrian deal of the year from Erste Bank.

-

A trio of Spanish issuers launched the first covered bonds of the year from southern Europe this week but, with peripheral spreads widening sharply, conditions are not conducive to further supply.