Daiwa Securities

-

Bank recruits three for public sector debt capital markets, another to move out to Middle East

-

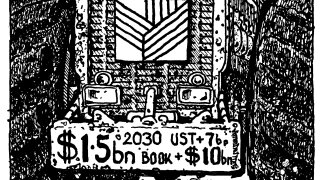

◆ Biggest book for Rentenbank in any currency, according to lead ◆ Agency raises $1.5bn ◆ Sets stage for more dollar issuance

-

◆ NIB, IADB, CEB price bonds ◆ Busy week drains liquidity from market ◆ Treasury spreads at 'historic' tights

-

◆ Volatility causes spread losses ◆ Issuer ‘flirted’ with intraday execution ◆ Level ropes in $2.35bn book

-

◆ Agency prints ahead of 'Liberation Day' ◆ Proactive approach to funding this year leaves issuer in good place ◆ Ten year euro social bond still in pipeline

-

◆ Dollar basis working for euro issuers in five year ◆ Maturity working for issuers in 2025 ◆ Deals come a day before Trump tariff announcement

-

◆ Four issuers out in dollars, three in the same maturity ◆ Swap spread moves foil tightening potential ◆ Deals getting done, but market isn't 'white hot'

-

◆ Four deals priced at same tenor, with a fifth also in dollars ◆ Why IADB increased size ◆ Swap spread moves cause complications

-

Bankers split on expectations as ‘everyone has been in the market’

-

Dutch agency prices 1bp back of World Bank Group borrower in ‘white hot’ market

-

Not all issuers drew large oversubscriptions in mixed market

-

Issuer intends to focus on conventional dollar bonds but euros and green deals are also possible