World Bank

-

World Bank is enjoying searing demand for its first Canadian dollar trade of the year on Thursday, with leads gathering a high quality order book for the five year print.

-

This week's scorecard focuses on the funding programmes of some of the major supranational borrowers, with the IADB's $2bn benchmark on Wednesday helping it near the halfway mark for the year.

-

Two deals this week highlighted the appeal of setting up SRI programmes. A pair of very different issuers appealed to new sets of investors showing that the growing asset class offers plenty to issuers — even if investors won’t pay up.

-

World Bank sold the first ever green Kangaroo bond on Wednesday, a five year note that proved popular with domestic investors. Syndicate officials are tipping other supras and agencies, attracted by the chance to diversify their funding base in the currency, to follow with similar trades.

-

World Bank will sell a debut green Kangaroo bond on Wednesday, mandating banks for a five year deal that bankers believe is the first in the format from any issuer.

-

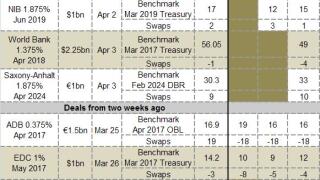

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The dollar market went from strength to strength this week, with a trio of issuers gliding seemingly effortlessly through tightly priced deals. While this may signal to other SSAs that it’s time for some aggressive pricing of their own, things might not be that simple.

-

The German State of Saxony-Anhalt sold its first benchmark bond of the year on Thursday, pricing it at the tight end of guidance — a common theme in euro benchmarks from public sector borrowers this week.

-

The World Bank followed in the footsteps of several other issuers this week to sell a tightly priced dollar deal on Thursday. While the four year note was priced flat to secondaries, some bankers away from the deal felt an even more aggressive level could have been possible.

-

World Bank is set to become the third SSA to tap the dollar benchmark market this week, announcing a four year deal on Wednesday. Nordic Investment Bank completed a dollar benchmark of its own the same afternoon, cruising through the deal despite a skinny spread over swaps.

-

This week's scorecard focuses on the funding programmes of some of the major supranational borrowers, with the World Bank having completed 90% of its target volume for its fiscal year.

-

Read on to see how deals priced earlier in the year are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.