The Netherlands

-

Martin Nijboer, head of securitizations at ING Bank, has explained why his bank has set up a new soft bullet covered bond programme, which received approval this week from the Dutch Authority for the Financial Markets (AFM).

-

Two of the strongest RMBS platforms in the European securitization market hit the market this week, and showed investors are still eager to grab the highest quality paper.

-

Veneto Banca and Rabobank have mandated leads for RMBS. The deals offer a generous pick up to what investors could expect in covered bonds given their comparably low risk.

-

NIBC Bank returned to the covered bond market on Tuesday to launch its second conditional pass-through covered bond (CPTCB). The unreconciled book suggested that the issuer attracted greater scale of demand from a wider group of buyers compared to its first deal. The growing acceptance of this innovative product at a much tighter spread bodes well for future use of this structure.

-

The Dutch covered bond market could be poised to expand, after the Finance Ministry published draft proposals that would allow lower-rated borrowers to issue bonds and set up programmes backed by small to medium sized enterprises. The news comes as NIBC prepares for the return of its conditional pass-through structure and amid talk that other Dutch RMBS issuers are now considering setting up such programmes.

-

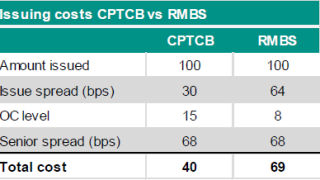

DBRS published a comment on Thursday comparing conditional pass-through covered bonds with securitizations. Investors in conditional pass-through structures must monitor the underlying assets, cash flows and extension risk more carefully than those investing in bullet maturity structures. Investors must therefore be more skilled in credit analysis.

-

NIBC Bank is planning to launch a second deal off its conditional pass through programme (CPTP) after mandating leads for a roadshow. The issuer’s outstanding deal has performed, but only after a fairly long period of time had elapsed, said bankers.

-

-

ABN Amro returned to the covered bond market on Thursday, issuing a €1.5bn 10 year deal with an attractive new issue premium. However, with the long end now saturated with supply and the secondary market still looking soft, questions continue to linger.

-

Despite some investors snubbing NIBC’s popular new conditional pass-through covered bond (CPTCB) structure when it was priced on Tuesday, analysts say there are a number of reasons why the structure should be on RMBS and covered bond investor buy lists alike.

-

The strong reception NIBC encountered for its conditional pass-through covered bond from traditional covered bond investors pays testimony to its regulatory endorsement from the Dutch central bank. This approval gave the product a much wider appeal than was initially expected, suggesting there is scope for a broader range of issuers to consider this structure than was first thought.

-

NIBC has priced the first conditional pass through covered bond in line with guidance building a comfortably oversubscribed book. But whether other issuers will attempt similar deals remains to be seen.