Sweden

-

Standard & Poor’s yesterday (Tuesday) revised the outlook on Skandinaviska Enskilda Banken’s A rating from stable to negative.

-

Skandinaviska Enskilda Banken confirmed the growing recovery of the jumbo covered bond market yesterday (Tuesday), pricing the first Scandinavian benchmark in six months. And the issuer suggested that others who do not pay the spreads now necessary to tap the market are deluded.

-

Skandinaviska Enskilda Banken is due to price a Eu1bn five year mortgage-backed benchmark later today (Tuesday). Market participants have been encouraged to see a jumbo from a new jurisdiction and were today working out just what the implications of the deal are for other potential issuers.

-

Skandinaviska Enskilda Banken is today (Monday) tapping the market with a five year benchmark covered bond, the first in six months for an issuer away from France and Germany.

-

Skandinaviska Enskilda Banken is today (Friday) testing the market for a new benchmark covered bond, The Cover understands.

-

Aareal’s debut SoFFin-backed issue has been the highlight of government-guaranteed supply this week, while BNP Paribas is today (Wednesday) adding momentum to a reopening of the unguaranteed senior bank market.

-

Moody’s downgraded Swedbank’s senior unsecured debt from Aa3 to A1 with a negative outlook this (Friday) morning.

-

Standard & Poor's and Moody’s have delivered verdicts on Skandinaviska Enskilda Banken with rating actions.

-

Activity in the euro government guaranteed bank debt market has picked up since Monday’s Swedbank issue, but only moderately. And despite an improvement in market sentiment, covered bond banks are keeping investors waiting for a follow-up to last week’s jumbo from Crédit Agricole.

-

Swedish issuers have told The Cover that it is unlikely they will be making use of the government guarantees available to them for covered bonds. While the costs of such issuance may be interesting relative to guaranteed senior unsecured issuance, other considerations work against it.

-

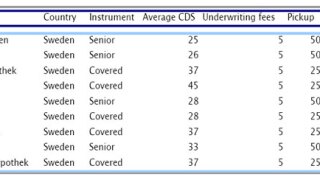

The Swedish National Debt Office yesterday (Tuesday) announced the bank-specific fees for use of the state guarantee for covered bonds. All charges for the guarantee programme have now been set.

-

Rating news: The Swedish Covered Bond Corp must take certain remedy actions set out in the documentation of its covered bond programme to mitigate the downgrade of its parent’s ratings by Standard & Poor’s last Wednesday, the agency said today (Monday).