Spain

-

Banco Popular Español returned to the covered bond market for the second time this year and reduced its reliance on retained issuance to bring a four year Cédulas, that was increased from €500m to €750m. Despite being barely oversubscribed and overly reliant on the domestic bid, the book was granular.

-

Sparebanken Vest Boligkreditt and Nordea have respectively mandated leads for a roadshow and a deal and another deal from Spain this week has not been ruled out.

-

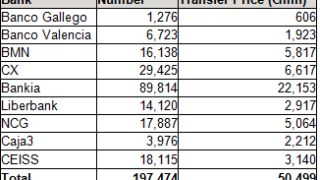

The secondary covered bond market saw modest flows on Friday but dealers reported a stronger bid for core names, in particular long end French deals which have not reacted to downgrades. In contrast, the multi-Cédulas sector remains offered reflecting its large exposures to the recently downgraded Bankia.

-

Core European covered bonds were supported on Thursday despite recent downgrades. But weaker Spanish names were under pressure on concerns that the European Central Bank could be poised to reconsider the repo treatment of covered bonds relative to ABS. Meanwhile, primary hopes were hit after it emerged that programme documentation delays could cause Canadian Imperial Bank of Commerce (CIBC) to launch its benchmark in September rather than next week.

-

The distinction between Spanish national champion banks and weaker lenders has become even starker, covered bond traders say. Spreads of multi-Cédulas and Cédulas from second tier banks have moved wider on the back of more rating downgrades.

-

Cover pool encumbrance was steady last year versus the previous year, Fitch said on Thursday. The most stable levels were among the most encumbered institutions, where covered bonds have made up a large share of their financing for a long time.

-

Caja Rural Navarra looks set to price its inaugural €500m five year covered bond at the tight end of guidance on an oversubscribed book. But concerns over absolute yield levels and the less than stellar performance of Cajas Rurales Unidas’s recent deal could spook investors, despite the attractive spread, said bankers.

-

The covered bond market is open for almost any issuer and though its unlikely that activity will pick up quickly, there are a number of potential transactions expected in the coming weeks, bankers told The Cover on Monday.

-

The subject of SME-backed covered bonds continues to provoke a sharp division of opinion within the industry. And it was a lively topic at the annual covered bond investor conference, held on Thursday in Frankfurt.

-

The Spanish region of Andalucia’s controversial plans to expropriate properties and stop evictions should not affect Cédulas holders, RBS said on Tuesday. Last week the regional government of Andalucia proposed a decree law to temporarily expropriate properties from financial entities if they are about to evict the occupants.

-

Banco Popular Español got the primary covered bond market off to a strong start on Monday after it took advantage of the prevailing demand for higher yielding bonds with a tightly priced tap of its March 2017 bond.

-

Caja Rural de Navarra has picked joint leads for a roadshow and possible deal. Its announcement late on Wednesday came after Moody’s said that the prospective A3 rated €500m Cédulas was overcollateralised by 623% which will allay negative equity concerns.