Southeast Asia

-

Malaysia’s 1MDB is understood to be suing Deutsche Bank and JP Morgan as part of an effort to recoup more than MR96.6bn ($23.5bn) in assets that it claims are linked to the state investment fund.

-

Golden Energy and Resources drew in investors with an 8.875% yield on its bond on Thursday, allowing the mining company to raise $285m.

-

BOC Aviation has raised $250m from a tap of bonds sold just last month, finding solid support from US investors for its comeback.

-

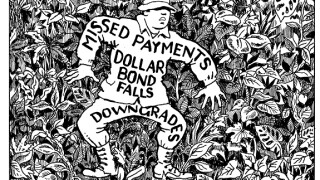

Indonesian textile company Sri Rejeki Isman (Sritex) saw its bonds plummet in the secondary market this week, as investors grappled with the company's missed debt payments and a series of ratings downgrades. Morgan Davis reports.

-

The Philippines’ equity capital markets got another boost this week as Monde Nissin Corp was swamped by investors placing pre-launch bids for its upcoming billion-dollar IPO, set to be the country’s largest ever listing. The market is shaping up to be one of the busiest in southeast Asia this year, tapping into growth in the consumer sector. Jonathan Breen reports.

-

Credit Suisse has made a number of appointments to expand its private wealth business in Asia.

-

Philippine property developer SM Prime Holding has returned to the loan market after an absence of five years.

-

Home Credit Vietnam is in talks with banks for a new $50m loan, with its planned fundraising receiving some early mixed response from lenders.

-

Indonesia's Sarana Multi Infrastruktur (SMI) has returned to the dollar bond market after a five-year absence, raising $300m.

-

Khazanah Nasional, Malaysia's sovereign wealth fund, has found overwhelming demand for its $1bn bond, attracting more than $5bn of orders.

-

Singapore’s Halcyon Agri Corp, a subsidiary of China’s Sinochem International Corp, has raised a $300m loan from a group of Chinese lenders.

-

Indonesian textile manufacturer Sri Rejeki Isman (Sritex) has seen its dollar bonds fall to new lows in the secondary market, as investors grapple with the company's missed debt payment.