South Asia

-

The Indian government is looking to add around Rp22bn ($329.6m) to its coffers with a sell down of a portion of its stake in construction company NBCC.

-

India's Delhi International Airport has launched its second international bond and this time is pushing for a longer tenor.

-

PNB Housing Finance and Varun Beverages are launching their IPOs in India next week to raise a combined Rp41.1bn ($616.9m).

-

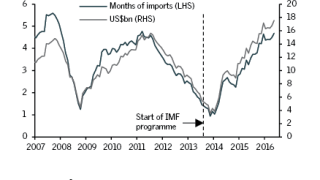

A frontier market that was flirting with insolvency just three years ago, is now in rude health. Investment is flooding into Pakistan from China, the West and the Gulf, attracted by high returns, rising stability and an economy underpinned by strong growth figures and a pro-business government.

-

Chinese investment has transformed Pakistan as an FDI destination. With the number of terror attacks falling and the northern borders about be opened up, Pakistan will become a major trading nation in the decades ahead, further boosting inflows of investment capital.

-

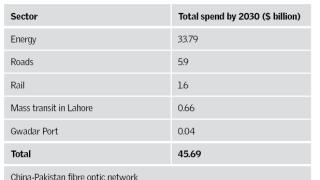

Pakistan is set to become one of the world’s great economies, benefiting the $46bn China-Pakistan Economic Corridor, which will link Beijing with the Indian Ocean overland for the first time. An influx of Chinese — and global — capital will boost growth and foreign direct investment, buoy the construction sector, and help transform Pakistan from a nation of separate and often fractured provinces, into a single, co-ordinated, consolidated country

-

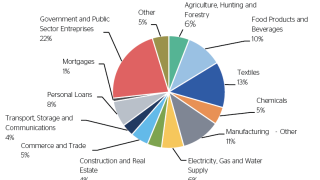

Pakistan’s banking sector is in its best shape for years, as bad loan ratios fall, capital adequacy and profits rise, and new legislation allows lenders to process a logjam of bad assets that has long bedevilled the system

-

Pakistan has long been considered an energy-poor nation. But oil, gas and coal finds, offshore and onshore, and major new port facilities and pipelines stretching the length of the country, could be set to transform the South Asian sovereign into a major energy player of the new century.

-

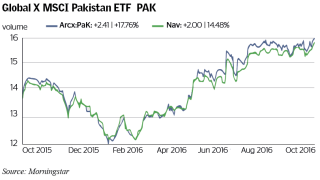

Pakistan’s capital markets are back in business after a few lean years, with M&A deal volume and the Karachi Stock Exchange at record highs, and investors chasing yield in a country now promoted to MSCI ‘emerging market’ status. Rules passing through parliament are expected to underline the country’s reputation as a great place to do business

-

Central Depositor Services India (CDSL) has won regulatory approval to go public by the end of March 2017, which could see the Bombay Stock Exchange-backed issuer valued as high as Rp14bn ($209.7m).

-

Indian solar power company Azure Power Global has traded down on its debut on the Nasdaq stock exchange after pricing its IPO below the price guidance.

-

An acquisition financing to back Indian company Intas Pharmaceuticals’ purchase of a portfolio of assets in the UK and Ireland is due to hit syndication soon. The loan is expected to be one of the first big ticket trades to be booked partly out of India’s international financial services centre, Gift City.