South America

-

One of the strongest credits in Argentina will look to entice bondholders to push out maturities by turning a portion of its existing bond into cash and increasing the coupon on the remaining amount.

-

A recent innovation in the green bond market — the transition bond — could help expand the issuer base, according to Credit Suisse’s head of environmental, social and governance strategy. But an investor said the standard of green bonds needed to be maintained.

-

Colombian natural gas distribution company Promigas had a smooth time on its first international bond market outing. Bankers said new issue markets in Latin America would continue to tick over, despite political volatility across the region.

-

The Inter-American Development Bank has published a report promoting the use of covered bonds as a funding tool for green developments in Latin America and the Caribbean. But it remains to be seen whether risk-averse covered bond investors are ready to take the plunge into emerging markets — particularly given regulatory hurdles in the swaps market.

-

Chilean copper miner Codelco is having trouble persuading existing note holders to part with their paper, after printing $2bn of new debt at record low yields in September.

-

Crisis-hit countries that go through a painful debt restructuring programme as part of a bailout enjoy much steeper cuts in their medium-term debt, according to an independent analysis of International Monetary Fund rescue programmes.

-

Brazilian ECM has surged this year, thanks to a belief in president Jair Bolsonaro’s plans for the economy. Brazilian corporates have taken advantage of investor excitement to raise more than $15.4bn in equity financing over the first three quarters of 2019. But this could be just the start, with a wave of privatisation also possible.

-

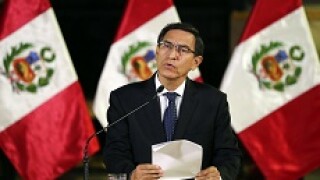

Latin America equity and bond investors have been left to consider the cost of political volatility in Peru, after the relationship between the country’s president Martín Vizcarra and its congress completely broke down on Monday.

-

Promigas, the Colombian natural gas distribution company, is hitting the road with a debut senior unsecured dollar bond offering.

-

Lat Am syndicate bankers were in bullish mood after Brazilian petrochemicals company Unigel clinched a seven year bond to complete a diverse few days of issuance from the region.

-

Interbank showed off the prowess of Peruvian issuers in international bond markets on Thursday as it topped up a dollar deal from the previous day with a nuevo sol tranche.

-

Uruguay made the most of the low rate environment on Thursday to tap two bonds for a total of $1.055bn. It was part of a liability management exercise that the finance ministry said produced a nominal financial benefit of $87m.