Singapore

-

Hong Kong-listed National Arts Entertainment and Culture Group is preparing to spin off and list a pair of assets as a trust on the Singapore Exchange.

-

Sumitomo Mitsui Banking Corp and ANZ are making changes to their loans businesses in Singapore. SMBC is building up its distribution capabilities, while ANZ is looking to replace a senior banker.

-

CDL Properties has thrown open the doors for the Singapore green bond market, launching its deal on Thursday, just two weeks after the country announced a grant scheme for socially responsible issuers.

-

Modernland Realty launched a new dollar deal on Thursday, following on the success of other high yield Indonesian names this year.

-

Three senior members of Deutsche Bank’s Asia debt and equities teams have left, with two of them jumping ship to Credit Suisse.

-

Ascott Residence Trust has wrapped up its rights issue 1.8x covered, raising S$442.7m ($313.7m) for the Singapore real estate investment trust.

-

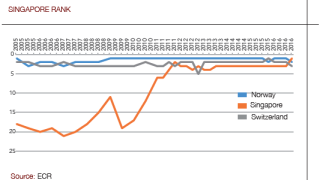

The nation state is the safest in the world, according to Euromoney Country Risk, but its neighbour Malaysia is heading in the opposite direction. And, at last, it looks like it is India’s time to shine

-

Stressed situation in oil and gas exposures weigh on annual results, but CEOs hope to see a wealth management upside

-

Sumitomo Mitsui Banking Corp has beefed up its loans distribution team for Asia, in line with its objective to build its capabilities in the business.

-

Singapore-based Fullerton Healthcare sealed an inaugural dollar-denominated perpetual from a company in the healthcare sector in Asia, bagging a larger-than-expected $175m from its first dollar outing on Thursday.

-

Senior loans banker Sean Joseph left ANZ Bank on Friday, according to a source close to the matter.

-

High-end solar panel maker REC Solar has approached lenders in Asia for the first time, as it looks to raise up to $330m.