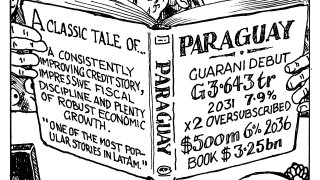

Paraguay

-

Sovereign also added $300m to a long-dated dollar note

-

Years of credit improvements have given landlocked country a loyal following among EM investors

-

Dominican Republic could be on the cards for LatAm supra after debuts in Paraguay, Costa Rica

-

Big name issuers finally return but aggressive approach unsustainable as aftermarket underwhelms

-

Investors happy to hold consistently improving credit

-

Structural reforms build ratings agency's confidence in LatAm performer

-

South American supra looking to diversify away from Swiss francs

-

It was easy for Paraguay to catch the eye of young fans following 1990s football

-

Solid credit story and small size help sovereign to slimmer concession than other EM deals

-

Borrowers push on but can't pay up much more, say bankers

-

South American supra is hitting its operational and lending targets

-

Frigorífico Concepción, the Paraguay beef exporter, sold its largest and tightest ever bond on Wednesday as it looked to continue its rapid expansion.