Nederlandse Waterschapsbank

-

Nederlandse Waterschapsbank priced a green bond on Thursday that was almost four times subscribed and came at a low concession to the issuer's curve. Another Dutch agency is exploring prospects in the market and expects to sell a debut deal later this year.

-

Nederlandse Waterschapsbank mandated banks on Monday to arrange investor meetings ahead of a possible debut socially responsible bond. The issuer will look to replicate the success of fellow Dutch agency FMO, which sold its first SRI deal in November.

-

This week SSA Markets provides funding updates on key European supranationals and agencies. Click here to find out which issuers have completed over half of their 2014 funding requirements.

-

The European Bank for Reconstruction and Development sold its first benchmark of 2014 on Tuesday afternoon, an aggressively priced five year dollar deal.

-

The European Bank for Reconstruction and Development picked a group of banks to launch its first benchmark of the year on Monday, as a pair of agencies announced smaller dollar mandates.

-

This week SSA Markets provides funding updates on key European supranationals and agencies as we near the end of the first quarter. Click here to find out which issuers have completed nearly half of their 2014 funding requirements.

-

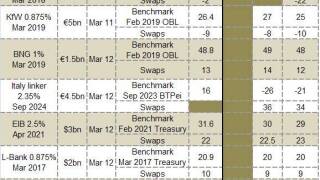

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Nederlandse Waterschapsbank rounded out a solid run of dollar issuance on Thursday when it sold a new five year deal. Bankers away from the deal were impressed with the final size of the benchmark, NWB’s first in the currency in 2014.

-

Nederlandse Waterschapsbank will add to a spate of dollar issuance on Thursday, selling its first benchmark in the currency of the year. Strong responses to trades from the African Development Bank, Caisse des Dépôts et Consignations and Oesterreichische Kontrollbank on Wednesday bode well for the issuer.

-

Read on to see how benchmarks priced in the first three weeks of the year are performing in the secondary market. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark bond as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Nederlandse Waterschapsbank failed to get over the line with a benchmark offering in the belly of the curve on Monday, despite offering a new issue premium of several basis points. Bankers away from the deal suggested that the choice of maturity prevented the issuer from offering an attractive pick-up compared to recent deals from peers and expected supply.

-

Nederlandse Waterschapsbank (NWB) is expected to sell its last public deal of the year on Thursday afternoon, opting for a short dated dollar floater. Demand for the floating format could spike in the new year if investors think the US Federal Reserve will reduce its support for the country’s economy, said bankers.