Nordics

-

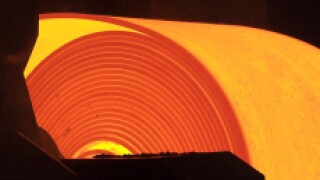

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

Allied Irish Banks was unable to bring in pricing from initial price thoughts on Tuesday. SpareBank 1 SMN appeared to be finding more success with its senior preferred offering.

-

-

With much of the great and good of the public sector markets busy at the Euromoney Global Borrowers and Bond Investors Forum in London (see page 6 for full coverage), deals were thin on the ground this week. But one Nordic agency was able to build its largest ever order book in dollars and, with conditions looking strong, both that currency and euros are likely to be packed next week, said bankers.

-

Danske Bank’s additional tier one note struggled to remain above water in the secondary market on Thursday as subordinated financials debt across Europe sold off. Other banks with plans to issue the instrument will be watching the market closely.

-

Clients of bank index platforms are adapting to a new investment climate, increasingly opting for more defensive strategies and specifically positioning for volatility spikes similar to the ones markets experienced in early February.

-

Finnvera has become the first European SSA borrower to print a five year dollar benchmark since early March, picking up $1bn with a Reg S/144A benchmark.

-

Finnvera is set to bring a deal in what has become a rare tenor in dollars, after mandating banks on Tuesday for a five year Reg S/144A benchmark.

-

It is a mark of how far the market has come from a barren week at the end of May that not just one, but three deals, totalling €2.75bn, were priced on Friday. The European Central Bank meeting and the expectation of a deal from German pharmaceuticals company Bayer played their part in the issuers’ decisions on timing and the order books justified those choices.

-

The Helsinki listing of Finnish property firm Kojamo was priced on Thursday and rose in trading on Friday morning, continuing the good run for Europe’s IPO market.

-

-

Public sector borrowers looking for dollar funding are likely to have to go even shorter than they have been used to after this week’s Federal Open Market Committee meeting, said SSA bankers.