Nordic Investment Bank NIB

-

The Nordic Investment Bank is set to become the third SSA issuer this week to sell an SRI bond, after posting initial price thoughts on Wednesday for an April 2020 in Swedish kronor.

-

World Bank has unveiled a five year Kangaroo hot on the heels of a Nordic Investment Bank tap of a 2020 bond in the format.

-

Nordic Investment Bank on Monday made its second appearance in the Kangaroo market this year, announcing a tap of a five year line.

-

Asian Development Bank raised over A$1bn ($808.3m) with a new five year Kangaroo and a tap of a 10 year line in the format on Friday, while European Investment Bank topped up its May 2018s to A$1bn. Bankers expect more supply in Australian dollars from public sector borrowers next week.

-

The pioneering spirit of supranationals in the green bond market will be just as strong in 2015 as this year, with many looking to expand their reach in the asset class.

-

The Nordic Investment Bank drew plenty of demand on Tuesday for its debut green bond, which is also the longest dated dollar deal in the format by a supranational issuer.

-

The Development Bank of Japan will make a rare appearance in euros when it brings what is believed to be the first ever green bond by a Japanese issuer, the agency announced on Monday.

-

Nordic Investment Bank tapped a short 10 year Kangaroo bond on Monday, while European Investment Bank added R400m ($37.4m) to a five year line.

-

This week's scorecard features Scandinavian agencies. Most of these borrowers are at least halfway through their funding programmes as issuance begins to slow for the summer.

-

This week's scorecard features Scandinavian agencies. Most of the issuers have completed half of their funding requirement.

-

Longer than normal floating rate notes and currency plays could provide a large part of the private placement landscape over the coming months, funding officials and dealers said this week, in the wake of the European Central Bank’s decision to lower interest rates.

-

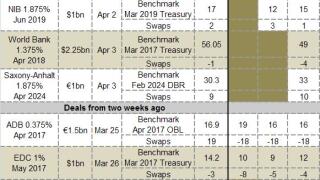

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.