Mizuho

-

Philippine consumer food and beverage company Universal Robina Corp’s NZ$742m ($537.57m) loan has been allocated, with 10 banks joining the syndication. The loan, which is for the company’s acquisition of New Zealand’s Griffin's Foods, received a good response thanks to the lack of top tier offshore deals out of the Philippines.

-

The European high yield market on Tuesday keenly accepted the first triple-C rated deals of the year: a buyout financing bond from Swiss carton maker SIG Combibloc and a refinancing issue for Norske Skog, the paper company.

-

Air Products and Chemicals priced a €300m 10 year bond on Tuesday - its fourth visit to the euro market, and in a familiar format.

-

Air Products and Chemicals, the US gases and chemicals producer, held an investor call today for a possible euro bond issue.

-

United Asia Finance (UAF) has closed its latest fundraising at a higher than launch size of HK$2.859bn ($368.8m). With most Hong Kong blue chips going for the club or self arranged route, the deal stood out, offering banks to join in retail syndication.

-

Philippine consumer food and beverage company Universal Robina Corp’s NZ$742m ($537.57m) loan has been allocated, with ten banks joining the syndication. The loan, which is for the company’s acquisition of New Zealand’s Griffin's Foods, received a good response thanks to the lack of top tier offshore deals out of the Phillipines.

-

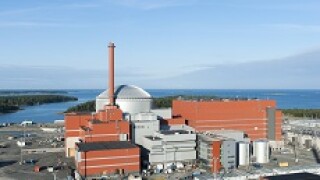

Teollisuuden Voima, the Finnish nuclear power company, priced a €500m 10 year bond on Thursday, as it brought forward its funding plans to take advantage of a European bond market energised by the prospect of quantitative easing.

-

Having established itself as a player in European DCM, the bank has bigger ambitions in fixed income and beyond, writes David Rothnie.

-

Pelabuhan Indonesia II (Pelindo II) surprised loans bankers this week with its decision to limit a $1bn borrowing to just over half that amount, causing the cancellation of general syndication. This was just the latest twist for a loan that has been anything but straightforward, though the outcome is unlikely to hurt the borrower in the long run.

-

Chinese consumer electronics appliance maker Haier International has allocated its three year facility at a larger-than-launch size of $360m. The borrower’s relationship banks came in with big tickets, encouraged by the company's growth potential and leading position in China.

-

In the latest twist in the saga of port services provider Pelabuhan Indonesia II’s $1bn loan, the borrower has decided to scrap general syndication and limit the deal to $550m which had already been prefunded by the seven banks leading the transaction.

-

Taiwanese computer casings maker Casetek’s $300m three year financing has attracted five banks in syndication.