Latin America

-

Bond buyers are showing interest in Peru’s nuevo sol denominated paper amid a sharp increase in EM risk appetite, according to the government’s public treasury director, even as Fitch downgraded the sovereign’s local currency debt rating last week.

-

The Central American Bank for Economic Integration (Cabei) raised $530m-equivalent of debt in Taiwan and Switzerland this week to complete the bulk of its bond financing for the year, leaving the lender to focus on bilateral funding and further investor relations for the rest of the year.

-

While leading economists fret about a reckoning to come for emerging market debt in the wake of the coronavirus pandemic, for vast swathes of EM issuers bond market business is brisk. Despite dire data and forecasts, dollar funding costs for some sovereigns are nearing pre-crisis levels as investors grasp at any sort of yield. The rally may have further to run, write Ross Lancaster and Oliver West.

-

Central American Bank of Economic Integration (Cabei) turned to the Taiwanese market on Wednesday, raising $375m just weeks after a $750m bond sale in the US.

-

Brazil became the third Latin American issuer in three days to find bond buyers willing to place large orders even as pricing was pushed below their initial demands, as it raised $3.5bn of five and 10 year paper to provide arguably the starkest example yet that technicals are trumping fundamentals primary emerging market new issues.

-

Latin American bond bankers were hopeful that Cemex’s blowout bond issue on Tuesday could cajole other issuers into the market after the Mexican cement producer navigated volatile secondary market and a rating downgrade to notch a hefty order on the way to a $1bn seven-year bond.

-

The Central American Bank for Economic Integration (Cabei) is set to price a senior unsecured Formosa bond on Wednesday after tightening price discussions.

-

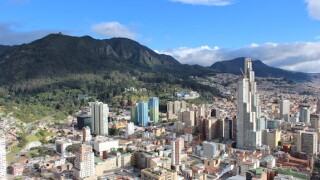

Colombia may have arrived late to the coronavirus-era Latin American sovereign bond market party, but the wait paid off on Monday as the sovereign notched a dual tranche $2.5bn issue that included its lowest ever coupon on a long dated bond.

-

Mexican cement maker Cemex is likely to announce a new dollar bond first thing on Tuesday after holding investor calls on the same day Fitch downgraded the borrower and placed it on negative outlook.

-

Argentina said on Monday evening that a new proposal to creditors was imminent after the government again extended the participation deadline in its restructuring. Optimism continues to grow over the chances of an agreement — even as an IMF statement on the process triggered forthright responses from bondholders.

-

Suriname’s sovereign bonds traded up in the wake of last week’s elections, despite doubts over a looming debt payment and even as a candidate who has promised discussions over the country’s rapidly rising debt stock looks to be nearing power.

-

Latin American development bank Corporación Andina de Fomento expects the social bond universe to grow after bringing forward its debut social bond to raise funds for its Covid-19 mitigation efforts.