LatAm Bonds

-

Argentina’s resurgence in international bond markets helped JP Morgan end 2016 as the top firm in primary in Latin America bond markets, up from sixth place in 2015, according to Dealogic.

-

Brazilian steel company Usiminas has given its dollar bondholders until January 12 to approve its restructuring of domestic debt, the second time it has pushed out the deadline.

-

Donald Trump’s election as US president has shaken up expectations for this year. But although Latin American borrowers are getting used to higher funding costs, 2017 could be a year of steady progression for the market, writes Olly West.

-

Brazilian company Suzano Papel e Celulose, which sold green bonds both internationally and domestically this year, is keen to issue more green bonds when it has eligible projects to fund, according to the company’s CFO.

-

Brazilian steel company Usiminas has extended the deadline for bondholders to waive the negative pledge covenant in its 7.25% dollar-denominated bonds due 2018.

-

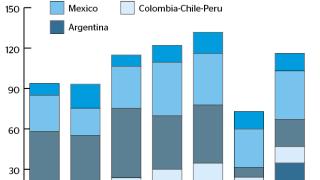

The return of new issuance to Latin America earlier this month means 2016 is set to end as the second largest year ever for new bond issuance in Latin America. And bankers are confident the numbers can continue to grow next year — despite external headwinds.

-

Brazilian telecoms giant Oi said on Monday morning that it would “carefully analyse” a restructuring proposal by bondholders after meeting Moelis, which is representing creditors, and a potential new investor on Friday.

-

YPF, the Argentine state-owned oil and gas company, could return to bond markets next year after a busy 2016.

-

Years of sub-par growth may finally hurt the ratings of Latin America’s two strongest economies, after Fitch placed Mexico and Chile’s ratings on negative outlook.

-

EM bond investors appeared unalarmed by the doom and gloom that rating agencies cast upon Latin American corporates this week.

-

Bonds markets in Latin America were firmly in holiday mode this week but syndicate bankers appeared bullish about issuance prospects for 2017 after the region brushed off the US rates hike.

-

It’s that time of year when analysts dust off their crystal balls and make predictions for the next 12 months. In December 2015 not many were forecasting that Britain would vote to leave the EU, and even fewer were betting on a Donald Trump presidential victory, so investors would be wise to treat such missives with caution. Political risk is a capricious beast, even for the most seasoned market observers.