LatAm Bonds

-

Swiss franc market offered alternative to US PP for Chilean coke bottling franchise

-

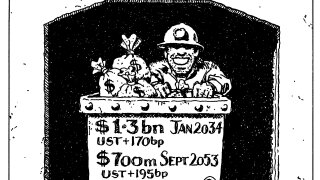

JBS also sells a dual-tranche as well-known names waste no time after Labor Day

-

Uncertainty looms but some see encouraging signs in firebrand candidate’s post-primary messaging

-

Proposed new issue is a securitization of IDB Invest’s purchase of securities from electricity generation companies

-

Investors don’t like Mexico kicking the can down the road on Pemex, but are happy to take the same approach themselves. This is bad news for everyone

-

Dominican Republic could be on the cards for LatAm supra after debuts in Paraguay, Costa Rica

-

Next deal could include targets on climate change adaptation or biodiversity

-

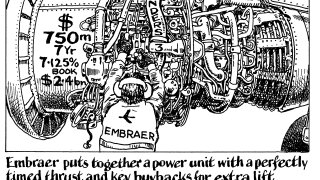

LM component supports demand as Brazilian issuer raises $750m

-

The issue comes after a bond exchange offer and payment relief agreement from lessors

-

New bond will have had 'fantastic' technical support

-

Sovereign to start non-deal roadshow but peso deal a possibility

-

LatAm hopes for better but rate risks still loom large