KfW

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Europe’s most frequent issuers in the Japanese Uridashi market are testing new structured products as investors increasingly look to equity linked paper to enhance yields.

-

Public sector borrowers looking to sneak in dollar bonds before the market traditionally closes for the year on Thanksgiving next week can step into a roaring hot market. The amount of cash available to be put to work has been resoundingly demonstrated by a pair of borrowers printing some of the largest deals ever at the long end of the curve.

-

-

Asian Development Bank announced a seven year deal on Thursday as KfW wrapped up a $5bn 10 year that drew over $7bn of orders.

-

This week's scorecard features updates on the progress of selected European supranationals and agencies through their funding targets for the year. Read on to see which have room for one more benchmark in 2014.

-

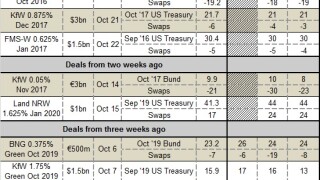

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

KfW this week returned to the Canadian dollar market in benchmark size, the first time it had done so in more than a year.

-

KfW returned to the Canadian dollar market in benchmark size for the first time in more than a year on Thursday.

-

KfW had to keep books open for longer than it is used to when selling a three year dollar benchmark on Tuesday, but it still impressed bankers by getting the trade away at a tight level. Viewed as a deal breaker for other issuers to come in dollars this week, KfW’s success meant that more trades could join FMS Wertmanagement, which mandated banks for a two year deal on Tuesday afternoon.

-

KfW is set to bring a three year dollar benchmark on Tuesday, in what bankers say could be a tight window for issuance in the currency. At least two other borrowers are thought to be looking at dollar deals this week, but may wait for KfW to test the water first.