KfW

-

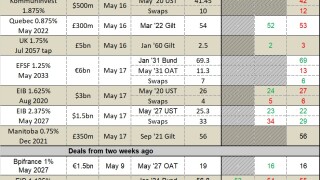

This week's funding scorecard looks at the funding progress various European supranationals and agencies have made in their funding programmes.

-

KfW is the solitary SSA issuer out in dollars so far this week, and it is sticking to the very short end with an 18 month deal, a week before a US Federal Open Market Committee meeting at which investors overwhelmingly believe it will raise its target rate.

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

A strong public sector dollar market welcomed one issuer's first $5bn sized deal this week. It was not even the only borrower to sell in size but with SSAs well-funded, there are few expectations of more large trades.

-

-

KfW launched a three year global on Tuesday, raising $5bn, while Japan Bank for International Cooperation picked banks for a four tranche dollar trade.

-

Oesterreichische Kontrollbank (OeKB) returned to the sterling market on Tuesday, raising £350m with a five year deal.

-

KfW will be the first public sector borrower to test a dollar market where swap spreads have rebounded off the 2017 lows they hit in the middle of last week.

-

The Kangaroo market witnessed a flurry of deals this week as issuers dipped into an investor base starved of paper. The rush of deals follows a period of inactivity during which pricing –– compared with other niche currencies –– had been unfavourable, forcing issuers to wait until costs worked for them again.

-

KfW has raised the threshold of sustainability it requires as an investor, the latest in a growing trend for bond buyers to focus on the impact of their investments.

-

Emmanuel Macron’s election as French president last weekend was the catalyst for a flood of revved up euro deals this week, with issuers and investors aiming at the long end of the curve as the biggest known political risk in Europe this year passed with a market-friendly outcome. Craig McGlashan reports.

-