Japan

-

S&P has raised Indonesia’s long-term sovereign credit rating to BBB- from BB+ with a stable outlook, on the back of reduced risks to the country’s fiscal metrics. Seven corporates were also upgraded by the agency last Friday.

-

Société Générale started marketing its a non-preferred senior transaction in yen on Tuesday, as French banks flood back to calmer markets following Emmanuel Macron’s victory in the country’s presidential election.

-

Credit Suisse has named Tsunehiro Watabe as senior adviser in Japan to drive the Swiss firm’s focus on entrepreneurs and its integrated wealth-plus-investment banking product.

-

Sumitomo Mitsui Financial Group and Bank of Taiwan have inked a memorandum of understanding to collaborate on asset finance, and to provide support to Taiwanese companies operating in ASEAN.

-

Tokyo-headquartered Orix Corp, which provides financial and investment services, has tied up a $400m two year financing with a group of banks.

-

The potential sale of Toshiba’s multibillion dollar flash memory arm is drumming up interest among banks that are looking for opportunities to finance the bidders. Depending on the outcome of the sale, the transaction could result in big business for European, Taiwanese and Japanese lenders, said market observers. Shruti Chaturvedi reports.

-

Law firm Clifford Chance has appointed five new partners in Asia Pacific, including one capital markets specialist, according to a Tuesday press release.

-

Decker & Co, a US-based institutional equities broker that focuses on Asia, has made several new hires to expand its coverage in China and Japan.

-

Japanese lender Daiwa was the only borrower to hit the US market this week ahead of an expected uptick in issuance as big US banks emerge from earnings blackout.

-

Thriving local investor demand, as well as determined government efforts at both national and local level to finance Japanese green projects, could soon encourage an underwhelming domestic green bond market to bloom, writes David Bell.

-

A feeling of cautious optimism surrounds the Japanese economy, according to minutes from the Bank of Japan’s monetary policy meeting in January. This positive mood is encouraging some to suggest that, under the dramatic reforms of prime minister Shinzo Abe, the country is on the right track.

-

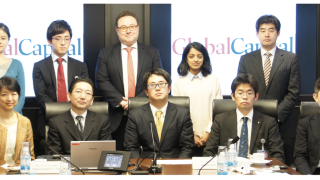

Four years after Abenomics was implemented, and following ratings downgrades in 2015, prospects are beginning to improve for Japan’s top credits. With the financial year starting in April there are reasons to be positive. Foreign investors are returning to the Japanese debt market, the economy is showing some improvement and companies are ramping up their funding targets. GlobalCapital sat down with senior officials from some of the most highly regarded issuers in Japan, as well as respected bankers, to find out about their fundraising plans and how they will approach the debt markets.