Japan

-

The European Investment Bank (EIB) has moved its new Climate Awareness Bond (CAB) documentation beyond the eurozone with the sale of a Polish zloty bond to a single Japanese investor.

-

In this round-up, former Bank of China chairman Chen Siqing has been moved to be chairman of Industrial and Commercial Bank of China, China’s gross domestic product (GDP) grew 6.4% and the first batch of funds keen to invest in Shanghai tech board listing have received approval to do so

-

Nomura announced in its results on Thursday that its wholesale business made a loss both in the fourth quarter and in the year as a whole. The Japanese bank is looking to cut back the division.

-

CLO anchor investor Norinchukin Bank is said to be looking at a full calendar of deals in the next two months, leaving some managers not on the Japanese bank’s list planning to revive structures not seen since before the last crisis in a bid to drum up interest and improve the arbitrage function of their CLOs.

-

Bank of America announced a series of leadership changes in Japan and Australia last week.

-

Nomura’s growth plan in its latest restructuring depends on sweeping away regional fiefdoms while finding greater consistency. History suggests this could be a tall order, writes David Rothnie.

-

The executive chairman of Nomura’s Middle East and North Africa business is among those set to leave the firm as part of a big restructuring. Senior bankers in EMEA capital solutions and convertibles are at risk of redundancy

-

During an investor day on Thursday, Nomura said it will scale back some secondary trading operations in Europe, the Middle East and Africa (EMEA), as it seeks to adapt to global challenges in the wholesale sector and the region’s slower growth.

-

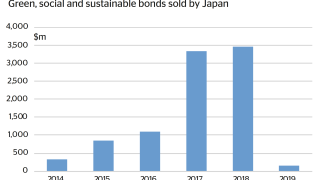

Outsiders often see Japan’s debt market as a staid place, where the maturity of investors and issuers leaves little room for innovation. The development of the green bond market puts the lie to that idea.

-

Japanese issuers’ supply of green bonds has rocketed in recent years. The country boasts a more diverse set of borrowers and a broader distribution of proceeds than many of its peers but further market development will present unique challenges, writes Morgan Davis

-

Japan’s top issuers occupy a unique part of Asia’s bond market landscape. They are well-regarded enough — and rated highly enough — that moments of fear in the credit markets can lead to more demand for their deals, rather than less. They face a domestic bond market defined by negative interest rates, an investor base that is ultra-sensitive to movements in the swap rate and an expectation from the government that their funding costs will remain tight.

-

The yen bond market, for all its vibrancy, cannot contain Japan’s ambitious issuers. Banks and corporates are building on efforts to woo dollar and euro investors as they thirst for new sources of funding, writes Morgan Davis