Italy

-

On Tuesday, Italgas was the latest issuer to benefit from the lack of corporate bond supply so far in 2018. Investors, starved of paper, have caused order books to be multiple times oversubscribed and issuers have benefitted from tight pricing as a result.

-

On Monday, Italian tyre company Pirelli returned to the bond market for the first time since its IPO. With no other investment grade deals in the market, the new five year transaction saw strong investor demand and 40bp of tightening from initial price thoughts.

-

Banca Popolare di Milano (BPM) successfully issued its first covered bond transaction since June 2016 with the high spread overcoming credit quality and volatility concerns.

-

-

Italy and Portugal showed this week that any concerns about the pace of eurozone quantitative easing halving to €30bn from January were overdone as they each built their largest ever benchmark books. Italy’s trade was particularly notable, as it was the last syndication by its retiring head of funding — and market stalwart — Maria Cannata.

-

-

Italian auto finance bank FCA Bank was in the market on Wednesday with its first benchmark floating rate note, which was priced with no new issue premium.

-

Italian electricity supplier Enel sold its second green bond on Tuesday, repeating the timing of its first such offering in 2017, which it also sold in the second week of the year. The latest deal was the same size, but priced tighter and won a larger order book, despite having a longer maturity.

-

UniCredit has become the first Italian bank to sell a non-preferred senior bond, clearing the path for further issuance out of the country.

-

A combined €48bn of cash swelled the orderbooks for Italy and Portugal’s deals on Wednesday, dispelling any fears that the reduction of the European Central Bank’s quantitative easing programme would hamper demand.

-

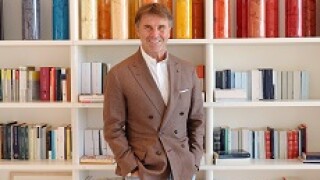

Brunello Cucinelli, the Italian luxury goods entrepreneur, sold a 6% stake in the fashion brand named after himself through a block trade on Tuesday night, to raise money to spend on charitable projects.

-

On Wednesday French toll road operator Autoroutes du Sud de la France followed the path its compatriot Orange had taken on Tuesday by issuing a €1bn 12 year new issue. Meanwhile Italian auto finance bank FCA Bank was also in the market with its first benchmark floating rate note.