HSBC

-

Industrial Bank of Korea bagged $500m from a social bond on Monday, with the proceeds pegged to help companies struggling because of the Covid-19 pandemic.

-

First Abu Dhabi Bank bagged Rmb1.4bn ($198m) on Monday from its largest offshore renminbi bond to date.

-

The New Development Bank and Kommuninvest began marketing new dollar benchmarks in the short end of the curve on Monday, with the former set to issue its long-awaited debut deal in the currency to support its member countries from the coronavirus pandemic.

-

The Islamic Development Bank (IsDB) has mandated for a sustainability sukuk, half a year after making its socially responsible investment debut with a green bond. It will use the proceeds to support Covid-19 relief efforts.

-

State Bank of India is on track to raise about Rp15.6bn ($204.7m) from an offer-for-sale of shares in its life insurance arm.

-

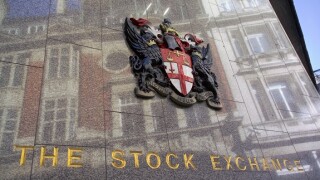

Shanghai-based China Pacific Insurance (Group) Co has launched its IPO on the London Stock Exchange, firming up the deal size and the syndicate group on the listing. The deal was covered on Friday, its first day of bookbuild.

-

Asian Infrastructure Investment Bank took home Rmb3bn ($424m) from its debut Panda bond on Thursday, at a price that was well below levels of its comparables. Senior officials at the Beijing-based supranational bank told GlobalCapital China that it wasn’t all smooth sailing, but the deal shows the potential of the renminbi debt market.

-

Chinese property developer Sinic Holdings (Group) Co launched a two year dollar bond on Thursday after receiving international credit ratings this week for the first time.

-

Chinese property developer Yanlord Land Group has returned to the loan market with a dual-tranche refinancing deal of up to $1bn.

-

Conditions in the financial institutions bond market worsened this week but plenty of senior and subordinated bonds still got away. With credit spreads unpredictable, the supply outlook remains favourable, said bankers.

-

NatWest Markets names CEO and CFO — Natixis appoints new managers for UK and Middle East — Barclays' private capital markets boss leaves

-

HSBC and Standard Chartered are facing a backlash from investors and politicians after publicly supporting China’s planned security law for Hong Kong.