Greece

-

Shareholders of ATE Bank, Agricultural Bank of Greece, yesterday (Monday) authorised the bank’s board of directors to set up a covered bond programme worth up to Eu5bn.

-

National Bank of Greece has completed its covered bond debut, launching two series of Eu1bn each off a Eu10bn programme. The bonds are thought to have been retained for possible use as collateral with the European Central Bank.

-

Marfin Egnatia has launched the second Greek covered bond programme and the first to use a direct issue structure.

-

National Bank of Greece is preparing to launch the first directly issued covered bond from Greece, after an amendment to the country’s bankruptcy legislation was passed last week that removed an obstacle to the bank’s plans. Hopes of opening up a second route to direct issuance have, however, receded.

-

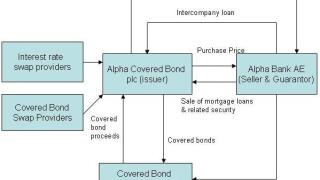

Alpha Bank has executed the first Greek covered bond issue, and will settle the deal off its new programme tomorrow (Friday). [Updated to include deal size, maturity.]

-

The first Greek covered bond appears to be approaching, with Alpha Bank expecting to finalise its programme by the end of this month and possibly giving a hint of the way in which the country’s issuance will be structured.

-

EFG Eurobank, the third largest bank in Greece, is poised to be among the first to take advantage of the new Greek covered bonds legislation. It plans to meet its wholesale funding target of approximately Eu4bn this year through a debut covered bond alongside two ABS issues.