Germany

-

HSH Nordbank has mandated joint leads for a €500m five year mortgage Pfandbrief, which is expected to be priced on Thursday. Market conditions for core issuers look favourable with Bund yields tightening further.

-

Bayerische Landesbank took advantage of an empty market to price what could be one of the last covered bonds before the summer lull kicks in. The €500m seven year Pfandbrief attracted a substantially oversubscribed and granular book that gained solid momentum from the start — in contrast to other recently issued Pfandbrief.

-

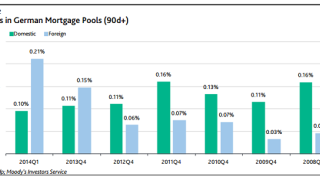

Arrears in foreign assets backing German mortgage Pfandbrief increased by 40% in the first quarter of 2014, according to Moody’s, although the share of foreign mortgages in Pfandbrief cover pools is on a steady decline.

-

Germany will not accept the latest iteration of the European Commission’s discussion on the liquidity coverage ratio (LCR) calling for a minimum A- rating for eligibility into the putative class 1B. Non EEA issuers of bonds rated AA- or higher may get into level 2A. LCR talks will be extended, but not the implementation date.

-

Berlin Hyp opened books on Monday for a deal which gave a positive litmus test on the condition of the core Pfandbrief market. The issuer may have been able to price a €500m deal at flat to Euribor but opted for a more liquid size at 1bp over mid-swaps in a move that was applauded but which shows resistance to sub-Euribor pricing has yet to be broken.

-

BPCE, Muenchener Hypothekenbank and Belfius Bank all launched 10 year covered bonds on Monday, underscoring the impression that investors are confident European yields could keep heading lower. Where once long end demand was dominated by real money, banks are now more dominant, a change that has been driven by the improved status of covered bonds in the liquidity coverage ratio.

-

Berlin Hyp is set to open books for a quick-fire five year on Monday and ahead of the Germany-Portugal World Cup match later that day. MuHyp and BPCE have also mandated leads.

-

The EBA have decided that they really don’t think it is a good idea that aircraft pfandbrief get a preferential risk weight along with other types of covered bond. Economically that is fairly trivial, there are only €1bn of these bonds outstanding and, since it is doubtful that many are held in banking books, it is questionable if they would get any benefit from a better risk weighting.

-

Deutsche Kreditbank (DKB) opened books on Wednesday on an Aa1-rated €500m 10 year mortgage-backed Pfandbrief, its second deal of the year and the third 10 year print to come out of Germany in 2014. A lead banker on the deal described the reception as tepid — a further indication of investor frustration with slender coupons offered by second tier Pfandbrief issuers, particularly on longer tenor bonds.

-

Deutsche Kreditbank has mandated leads for its second deal of the year and the third 10 year issued from Germany this year. Meanwhile, there is speculation that several Canadian issuers could return to the euro market.

-

The widely anticipated public sector-backed Pfandbrief from Dexia Kommunalbank on Tuesday had been expected to go well, given the juicy spread that was likely. But the level of oversubscription was the highest of any German deal this year and even put competing issuance from Portugal into the shade.

-

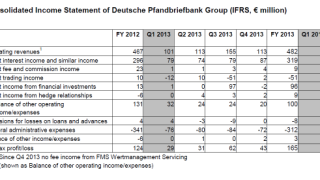

Deutsche Pfandbriefbank (Pbb ) reported a 31% pre-tax rise in profit on Monday, boding well for its privatisation — in marked contrast to Depfa plc. Pbb has launched two Pfandbrief deals this year and is likely to return to markets at least once and possibly twice this year, it confirmed to The Cover on Monday. For the time being, however, the covered bond market is expected to trade sideways as participants await news from the European Central Bank.