Germany

-

Landesbank Hessen-Thueringen (Helaba) tapped the three year leg of its dual-tranche issue from May on Thursday morning, mirroring the syndication strategy it used to tap the deal’s seven year leg in July — aggressive pricing and doubling the size of the issue.

-

German Pfandbrief issuers have been obliged to publish loan to value ratios for their cover pools from the second quarter, in the wake of an amendment to the Pfandbrief Act. Loan-to-value (LTV) levels are generally low by international standards, but such comparison would be misleading given German idiosyncrasies, said DZ Bank and Commerzbank analysts.

-

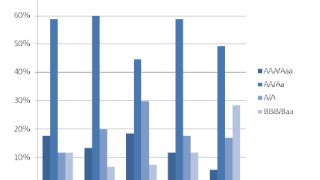

Appetite for risk in the covered bond market has risen markedly over the last two years, according to a survey of the 180 German investors who attended NordLB’s global capital markets conference on July 17. (This article has one comment)

-

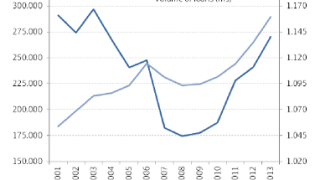

Growing demand for real estate finance in Germany is likely to trigger growth in mortgage Pfandbrief issuance over the medium term, said NordLB covered bond analysts in a recent briefing paper after outstanding mortage Pfandbrief volumes fell in 2013.

-

Deutsche Hypothekenbank, NordLB’s commercial real estate subsidiary, opened books on Monday for its first Pfandbrief of the year. Despite the time of year – this deal is the first German issuer to price a deal in the second half of July for over four years – leads attracted a heavily oversubscribed order book. Credit market conditions in the Euro area provided a constructive backdrop for execution, with Bunds stable and periphery markets recovering.

-

The first draft of the Pfandbrief Act 2015 offers some remarkable novelties, according to Commerzbank research, which said in its latest weekly publication that proposed changes should not cause any headaches — and may even improve transparency. Moody’s agreed saying that the draft proposals were credit positive.

-

Deutsche Hypo has mandated joint leads for a €500m five year mortgage Pfandbrief to be launched in the near future.

-

Landesbank Hessen-Thueringen (Helaba) sealed its place as the largest covered bond issuer so far this year after doubling the size of a seven year public sector backed Pfandbrief on Thursday. The approach, which mirrors last year’s strategy, has enabled the bank to raise a lot of funding at competitive levels while giving investors much needed liquidity, as well as minimising its asset-liability mismatches.

-

German bankers, who have been busy nursing their sore heads after celebrating their country’s World Cup victory on Sunday night, will not have been overly burdened by DG Hypothekenbank’s drive-by Pfandbrief syndication on Monday. Being the rarest issuer from one of the most technically squeezed jurisdictions in Europe, a strong outcome was never in doubt. Painkillers may however be required for the allocation process.

-

Three issuers launched covered bonds this week with varying results, which suggested that the converging trend between core and peripheral Europe has stalled. Banca Monte dei Paschi di Siena (MPS) struggled to attract anything like the demand seen in its previous covered bond as Portuguese woes outweighed the programme’s rating upgrade into investment grade territory.

-

DG Hypothekenbank has mandated leads for a seven year mortgage covered bond to be launched early next week.

-

HSH Nordbank opened books on Thursday for a deal which took advantage of Europe’s core markets’ recent tightening versus its periphery. Leads produced an oversubscribed book as Bunds rallied and peripheral sovereigns continued to struggle.